MENU

Starting a Business

- Best Small Business Loans

- Best Business Internet Service

- Best Online Payroll Service

- Best Business Phone Systems

Our Top Picks

- OnPay Payroll Review

- ADP Payroll Review

- Ooma Office Review

- RingCentral Review

Our In-Depth Reviews

Finance

- Best Accounting Software

- Best Merchant Services Providers

- Best Credit Card Processors

- Best Mobile Credit Card Processors

Our Top Picks

- Clover Review

- Merchant One Review

- QuickBooks Online Review

- Xero Accounting Review

Our In-Depth Reviews

- Accounting

- Finances

- Financial Solutions

- Funding

Explore More

Human Resources

- Best Human Resources Outsourcing Services

- Best Time and Attendance Software

- Best PEO Services

- Best Business Employee Retirement Plans

Our Top Picks

- Bambee Review

- Rippling HR Software Review

- TriNet Review

- Gusto Payroll Review

Our In-Depth Reviews

- Employees

- HR Solutions

- Hiring

- Managing

Explore More

Marketing and Sales

- Best Text Message Marketing Services

- Best CRM Software

- Best Email Marketing Services

- Best Website Builders

Our Top Picks

- Textedly Review

- Salesforce Review

- EZ Texting Review

- Textline Review

Our In-Depth Reviews

Technology

- Best GPS Fleet Management Software

- Best POS Systems

- Best Employee Monitoring Software

- Best Document Management Software

Our Top Picks

- Verizon Connect Fleet GPS Review

- Zoom Review

- Samsara Review

- Zoho CRM Review

Our In-Depth Reviews

Business Basics

- 4 Simple Steps to Valuing Your Small Business

- How to Write a Business Growth Plan

- 12 Business Skills You Need to Master

- How to Start a One-Person Business

Our Top Picks

QuickBooks Payroll Review and Pricing

Table of Contents

As the top payroll system for those seeking an accounting integration, Intuit QuickBooks Payroll easily transfers tax and payroll data to QuickBooks Online. Along with performing unlimited payroll runs, businesses can access competitive employee benefits.

- The competitive price and multiple subscription options make QuickBooks Payroll a flexible solution for small to midsize businesses.

- The software automatically syncs payroll and tax data, thereby reducing accounting errors and saving time.

- QuickBooks Payroll comes in an affordable contractors-only version with one monthly payment for up to 20 independent contractors or freelancers.

- QuickBooks Online Payroll offers fewer onboarding and hiring tools than Gusto and OnPay do.

- Retirement and health benefits are more limited with QuickBooks than with Rippling and ADP.

- Unlike its competitors' entry-level plans, QuickBooks Payroll's entry-level plan does not encompass local taxes or support multistate payroll and tax filings.

Payroll and accounting go hand in hand, making integrations between your financial software essential. Intuit QuickBooks Payroll is the best full-service payroll solution with an accounting integration, thanks to how it syncs seamlessly with QuickBooks Online. Whether you add a payroll module to your existing QuickBooks account or purchase a bundled plan, paying employees is a breeze. Moreover, small businesses benefit from tax filing for federal and state taxes through QuickBooks, as well as tax penalty protection.

Intuit QuickBooks Payroll Editor's Rating:

9 / 10

- Pricing

- 8.8/10

- Customer service

- 8.9/10

- Third-party integrations

- 9/10

- User interface

- 9.3/10

- Added HR tools

- 9/10

Why We Chose QuickBooks Payroll for Accounting Integration

As small businesses look to consolidate vendor contracts and streamline operations, Intuit QuickBooks offers the ideal solution for payroll and accounting needs. QuickBooks Online users can add payroll services to their existing subscriptions, while new customers can bundle payroll and bookkeeping or select a stand-alone Intuit QuickBooks Payroll plan. With a single solution like this, we love that you don’t have to integrate payroll with third-party tools or reenter payroll data into your accounting program.

Other payroll providers, like Paychex, charge fees for general ledger integrations. Only Patriot Payroll offers similar integration with its accounting software. However, QuickBooks Online is a market leader, with ICSID reporting that 29 million U.S. small businesses use the software. QuickBooks Payroll’s ease of use for running payroll, calculating employee deductions and viewing reports also factored into our assessment. These features and others make QuickBooks Payroll the best online payroll service for businesses seeking an accounting integration.

The QuickBooks Payroll Core package handles tax filing and payments, and also offers employee health benefits and 401(k) plans. The Premium and Elite plans include time-tracking tools and workers’ comp administration through AP Intego. Furthermore, we were impressed that QuickBooks Online Payroll offers eligible users next-day direct deposit on its base package and same-day direct deposit for Premium and Elite plans. The standard processing time among competitors is two to four days.

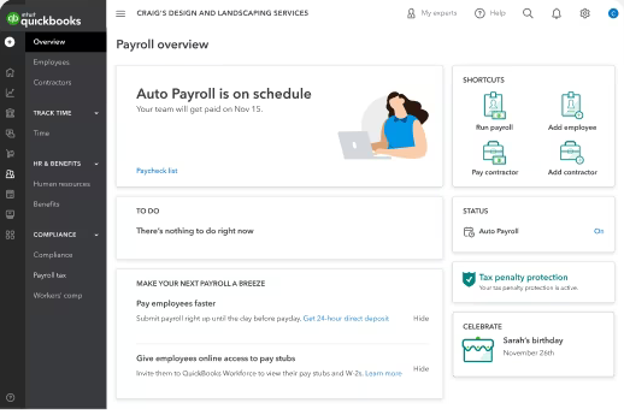

View essential payroll information from your QuickBooks dashboard. Source: QuickBooks

Miscalculating your payroll liabilities can result in IRS fines. QuickBooks offers tax penalty protection of up to $25,000 per year, which can help small businesses avoid unexpected expenses.

Ease of Use

When evaluating Intuit QuickBooks Payroll, we explored the online interface, mobile apps and workforce portal. In each case, the software was easy for new users to navigate, and if you’re familiar with the QuickBooks Online bookkeeping software, you’ll quickly recognize the layout.

The main screen shows your auto payroll status, upcoming birthdays and a to-do list. Also, you can tap on shortcuts to quickly run payroll, pay a contractor, and add an employee or contractor. We appreciated the timely alerts for upcoming tax payments, which allowed us to see the tax type, payment status and method.

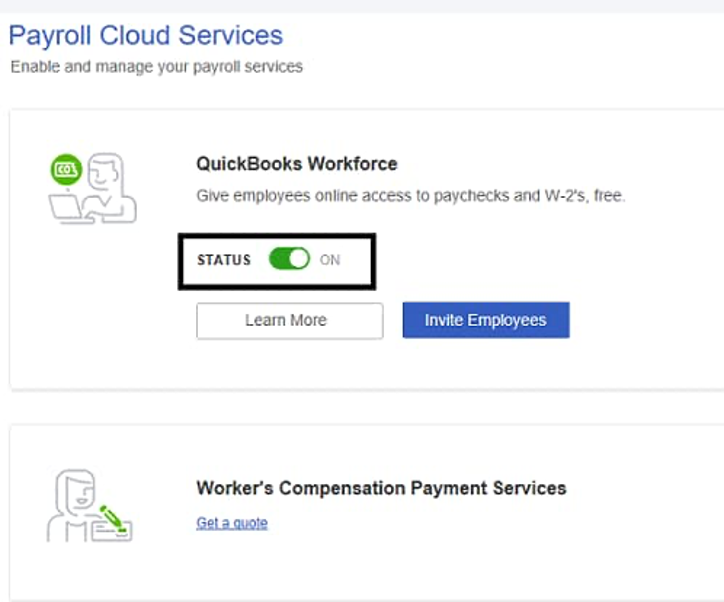

Because some QuickBooks Online Payroll versions include Intuit’s new (as of June 2023) employee workforce portal, adding new team members or updating information is simple. Employees enter information about their bank accounts and complete W-4 forms online. Then, employers select hourly or salaried employees, wage rates and additional pay types, and they’re ready to go.

Enable QuickBooks Workforce to allow your team to view payroll and tax information online. Source: QuickBooks

Salaried employees’ pay rates remain in the system, so you don’t have to enter their hours manually. However, you must input staff hours to run payroll if you don’t have integrated time-tracking tools. Depending on the number of workers, it could take five to 15 minutes. After reviewing your payroll summary, you simply click to submit it.

Alternatively, you can set up automatic payroll, which works best for companies with salaried staff on direct deposit. We also like that QuickBooks Online Payroll manages your state and federal taxes, so you don’t have to worry about missing a tax filing deadline.

Intuit QuickBooks Payroll Features

Small businesses that are looking for a streamlined solution for complex payroll tasks will appreciate QuickBooks Payroll’s capabilities. While features vary by plan, all tax and payroll processing services helpfully integrate with Intuit’s bookkeeping program.

QuickBooks Online Integration

Payroll ledgers, which involve payroll journal entries, are essential to recordkeeping whether you run payroll manually or automatically. Several payroll systems integrate with QuickBooks Online, but those payroll providers may charge you add-on fees for general ledger or integration services. With QuickBooks Payroll, there’s nothing to sync or troubleshoot when the programs suddenly quit connecting. It simply works, and that’s why QuickBooks Payroll tops our list for businesses that prioritize accounting integration.

Still comparing accounting and payroll tools? Read our full review of QuickBooks Online to learn why small businesses continually rate Intuit QuickBooks as the No. 1 accounting platform.

Unlimited Payroll Runs

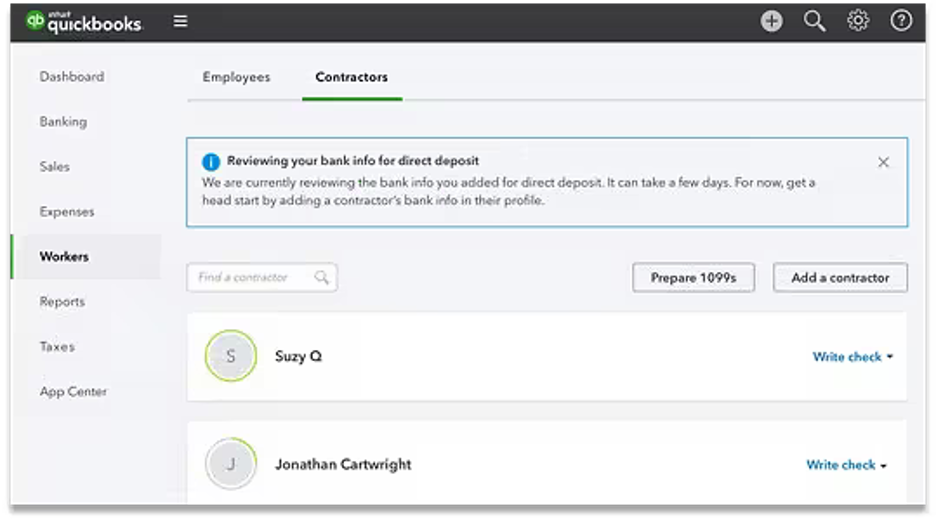

Several top-rated payroll services allow unlimited payroll runs. With an Intuit QuickBooks Payroll account, you can run payroll for employees, contractors or freelancers automatically or manually as often as you want. QuickBooks calculates wages and deductions to ensure accurate payroll withholding, and then business owners review and submit payroll for processing.

Easily toggle between W-2 and 1099 workers in your QuickBooks Payroll dashboard. Source: QuickBooks

Employee Payment Options

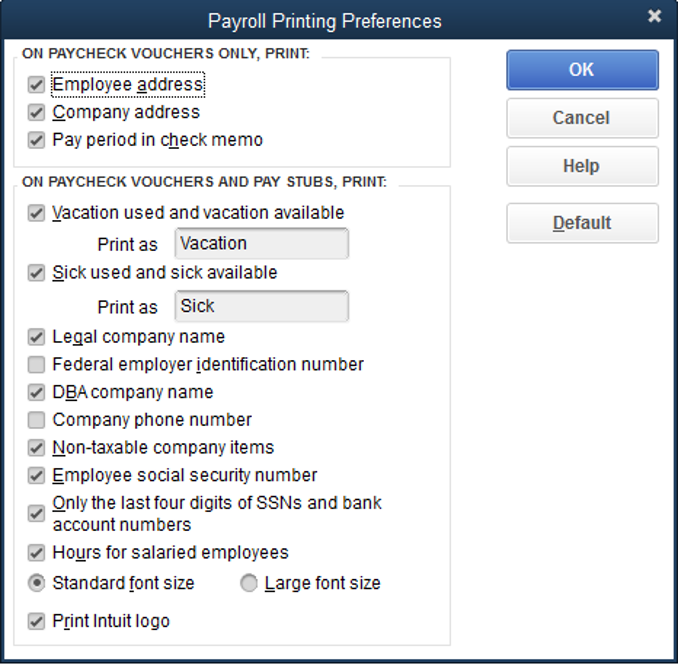

Similar to competitors, QuickBooks Online Payroll allows payment via direct deposit and paper checks, but depending on your subscription tier, additional fees may apply when you pay contractors via direct deposit. Your staff can view pay stubs via the workforce portal. Employees can also sign up for a Netspend Visa prepaid card as an alternative to direct deposit. Although we appreciate this option for unbanked individuals, the pay-card fees are higher than they are for competitors’ offerings.

Customize paychecks and pay slips, or use the system’s default options. Source: QuickBooks

Offering your staff on-demand wages and payroll cards can benefit diverse workforces. For more employee pay options, consider iSolved. This payroll solution integrates with QuickBooks Online and provides several direct deposit alternatives. See our iSolved review for more information.

Payroll Taxes

Most full-service payroll providers will automatically file taxes on your behalf. QuickBooks Payroll calculates, files and pays state and federal taxes. Note, however, that QuickBooks Online Payroll Core does not handle local taxes. The Premium and Elite plans require users to upload forms to local sites. Also, you can opt to file your payroll taxes manually.

Click the Taxes tab to view upcoming payroll tax payments and recent withdrawals. Source: QuickBooks

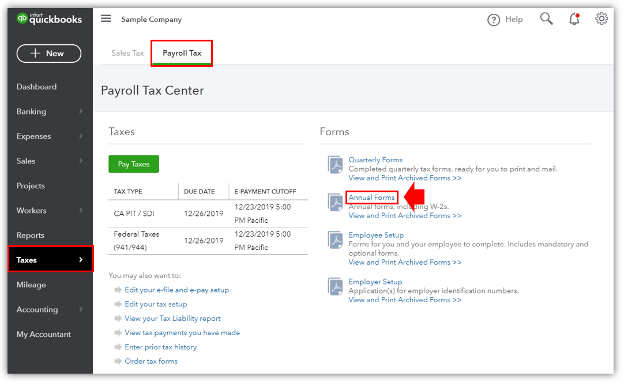

Year-End Tax Forms

Like many other payroll vendors we reviewed, QuickBooks Payroll manages your year-end tax form responsibilities. If you use automatic payroll processing services, QuickBooks will prepare and file your W-2 forms with the IRS. You can print them, or employees can view them in the workforce portal. However, it may cost extra to file or send 1099 forms, and fees may apply if you want your W-2s mailed.

See important deadlines and download forms in the Payroll Tax Center. Source: QuickBooks

Paid Time-Off and Benefits Administration

Many online payroll services administer retirement plans and health insurance or track paid time off (PTO). QuickBooks Payroll offers basic amenities. We liked that we could track sick and vacation pay or let the system automatically accrue hours per pay period. Employees can view available PTO through their portal.

QuickBooks Payroll partners with third parties for various benefits. SimplyInsured provides health benefits, Guideline covers retirement plans and AP Intego does workers’ compensation insurance. Availability varies by subscription and location.

If you want to boost employee retention rates by improving your benefits packages, consider a PEO that offers payroll services and Fortune 500 benefits.

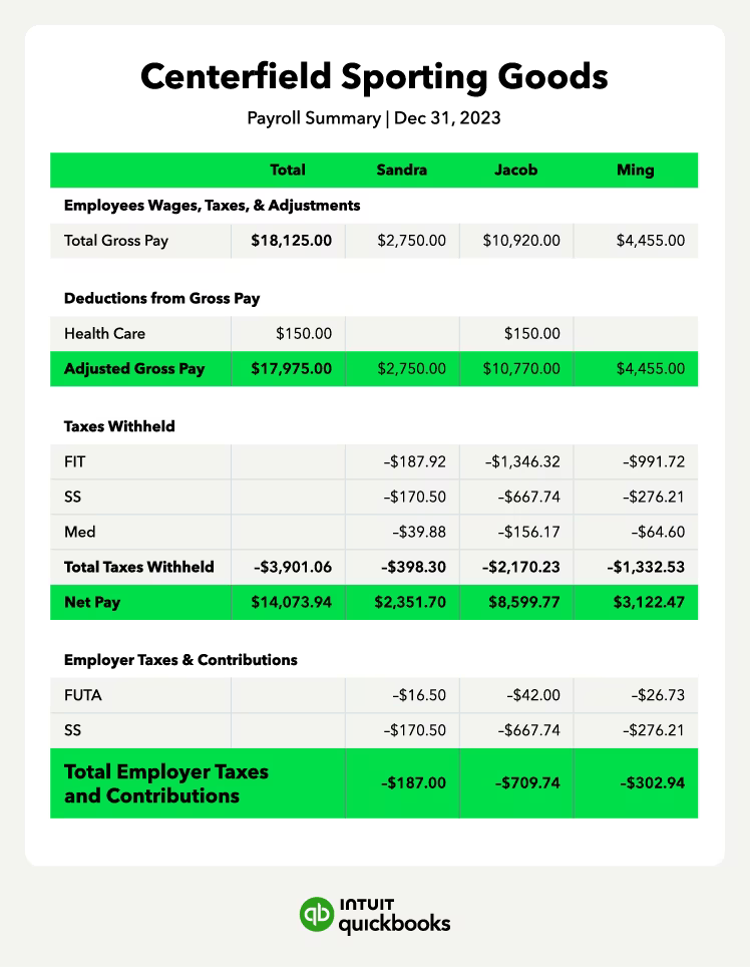

Payroll Reports

Typically, payroll systems let users view and download data by time frame, employee or location. QuickBooks Payroll reports include tax payments, PTO and payroll summaries. You can see information by employee or contractor. We like that you can also dive into workers’ compensation, edited time activities or employee details. [For deeper insights, check out our review of Rippling, which offers data visualization and workflow automation tools.]

.

Use QuickBooks payroll data to improve your payroll reporting and recordkeeping. Source: QuickBooks

Intuit QuickBooks Payroll Pricing

Intuit QuickBooks Payroll pricing starts at $45 monthly, plus $5 per employee per month. The service stands out for its variety of subscriptions; some competitors offer only one payroll plan. Here, along with stand-alone payroll packages, small businesses can bundle payroll and accounting software or choose a contractor-only plan.

All three base plans include next-day direct deposit for eligible clients. Full-service payroll processing packages have expert product support, and QuickBooks assumes responsibility for federal and state tax filings.

Here’s how the individual payroll plans differ:

- Payroll Core: For $45 monthly plus $5 per employee per month, businesses can set up automatic payroll, create and e-file 1099-MISC and 1099-NEC forms, and pay staff via next-day direct deposit. Retirement plans and health benefits are also available.

- Payroll Premium: This plan costs $75 monthly plus $8 per person per month. It includes same-day direct deposit, the QuickBooks Time mobile app and an initial expert setup review. Employers can access employee benefits, including workers’ compensation insurance, and an HR support center.

- Payroll Elite: For $125 monthly plus $10 per employee per month for a customized setup, businesses get a personal HR advisor and project tracking. QuickBooks provides tax-penalty protection of up to $25,000, and customer service includes video support.

- Contractor Payments: You can make unlimited payments to 20 contractors for $15 monthly and $2 per month for each additional contractor. This option allows contractor self-setup, next-day direct deposit and unlimited e-filing of 1099s.

Because QuickBooks recently discontinued QuickBooks Desktop 2020, most services and security updates for that program have ended. However, QuickBooks Online users can go to their Account and Settings page to add payroll to their desktop accounting platform.

We especially love that QuickBooks has several bundled packages for new users who want a one-vendor payroll and bookkeeping solution. You get access to the same health insurance options and automated payroll tax payments as you would with the stand-alone payroll plans, with the bonus of accounting software.

QuickBooks offers the following bundles:

- Payroll Core + Simple Start: Billed monthly at $75, plus $5 per employee

- Payroll Core + Essentials: Billed monthly at $100, plus $5 per employee

- Payroll Premium + Plus: Billed monthly at $160, plus $8 per employee

- Contractor Payments + Simple Start: Billed monthly at $45 for 20 contractors, plus $2 for each additional contractor

Implementation/Onboarding

Similar to Zenefits, QuickBooks provides an outline of how to set up your payroll system. It’s a self-guided process for Payroll Core users, and aside from entering data, we found it to be uncomplicated. You submit business and employee information, like pay rates, bank account details and payroll history.

Existing QuickBooks users can add payroll services to their accounting platform and follow the same steps to deploy the payroll solution. If you opt for the Premium plan, you can have an expert review your setup; if you’re an Elite user, QuickBooks will handle the entire configuration or migration process.

QuickBooks Payroll also makes it easy to onboard employees. Under the Payroll tab, click Employees and select individuals to send email invites to QuickBooks Workforce. Alternatively, you can add employees and invite them to enter their information during onboarding. Each time you run payroll, they’ll get an email informing them their pay stubs are available to view, print or download.

Customer Support

We appreciate that QuickBooks Payroll offers customer support via phone, email and live chat. However, unlike rival ADP, which provides around-the-clock service to all payroll subscribers, QuickBooks limits 24/7 access to Elite users. Core and Premium clients can contact customer support Monday through Friday from 9 a.m. to 9 p.m. ET.

Alternatively, you can post questions to the QuickBooks online community board or view tutorial videos and step-by-step how-to guides in the help center. Our interactions with the QuickBooks team were mainly positive, with relatively quick response times and accurate answers to our questions. However, some users have reported long wait times, which is somewhat typical for payroll providers during peak hours.

Small businesses that require more hands-on assistance may prefer a payroll solution that offers higher support yet still integrates with QuickBooks Online. Check out our review of ADP for one such option.

Limitations

Despite Quickbooks’ seamless accounting integration and bundling option, the system lacks the standard HR features provided by competitors. For example, our review of OnPay — our top payroll pick for small businesses — notes that it integrates with QuickBooks Online, automates onboarding and stores new-hire documents online.

We also wish QuickBooks Payroll included time-tracking features with all payroll packages, like Zenefits does. Instead, limited tools are available only with the Premium and Elite plans. See our Zenefits review to learn about its native scheduling and attendance tools.

Methodology

We examined dozens of payroll solutions that help small business owners realize the benefits of paperless payroll. Our investigations included speaking with company sales representatives and support agents. We experimented with demos, tested software and read user reviews. Our analysis considered usability, third-party integrations, payroll and HR features, and pricing. To determine the best payroll software for business owners who prioritize an accounting integration, we looked for vendors with all-in-one accounting and payroll products.

QuickBooks Payroll FAQs

QuickBooks Workforce is a mobile app for Android and iOS devices. It offers QuickBooks Time and QuickBooks Payroll features, but employees can only access the features for products their employer subscribes to. See our QuickBooks Time review to learn more.

QuickBooks discontinued its desktop accounting program in June 2023. This means Intuit no longer provides support or updates for the application, and companies can’t run automated payroll through it or purchase new payroll subscriptions with QuickBooks Desktop.

Restaurant owners can manually enter tips and establish a separate hourly rate for tipped employees in QuickBooks Payroll. However, the software offers less support for this than rivals like Gusto do.

Bottom Line

We recommend QuickBooks Payroll for …

- Business owners who want to add payroll to their existing QuickBooks Online software.

- Companies that prefer to bundle accounting and payroll solutions instead of buying separate subscriptions.

- Solopreneurs who are seeking an inexpensive contractor-only payroll option.

We don’t recommend QuickBooks Payroll for …

- Companies that don’t use QuickBooks Online for accounting.

- Large or fast-growing organizations that want to automate payroll and HR tasks.

- Small businesses that are looking for payroll software with many online onboarding tools for new hires.