MENU

Starting a Business

- Best Small Business Loans

- Best Business Internet Service

- Best Online Payroll Service

- Best Business Phone Systems

Our Top Picks

- OnPay Payroll Review

- ADP Payroll Review

- Ooma Office Review

- RingCentral Review

Our In-Depth Reviews

Finance

- Best Accounting Software

- Best Merchant Services Providers

- Best Credit Card Processors

- Best Mobile Credit Card Processors

Our Top Picks

- Clover Review

- Merchant One Review

- QuickBooks Online Review

- Xero Accounting Review

Our In-Depth Reviews

- Accounting

- Finances

- Financial Solutions

- Funding

Explore More

Human Resources

- Best Human Resources Outsourcing Services

- Best Time and Attendance Software

- Best PEO Services

- Best Business Employee Retirement Plans

Our Top Picks

- Bambee Review

- Rippling HR Software Review

- TriNet Review

- Gusto Payroll Review

Our In-Depth Reviews

- Employees

- HR Solutions

- Hiring

- Managing

Explore More

Marketing and Sales

- Best Text Message Marketing Services

- Best CRM Software

- Best Email Marketing Services

- Best Website Builders

Our Top Picks

- Textedly Review

- Salesforce Review

- EZ Texting Review

- Textline Review

Our In-Depth Reviews

Technology

- Best GPS Fleet Management Software

- Best POS Systems

- Best Employee Monitoring Software

- Best Document Management Software

Our Top Picks

- Verizon Connect Fleet GPS Review

- Zoom Review

- Samsara Review

- Zoho CRM Review

Our In-Depth Reviews

Business Basics

- 4 Simple Steps to Valuing Your Small Business

- How to Write a Business Growth Plan

- 12 Business Skills You Need to Master

- How to Start a One-Person Business

Our Top Picks

Xero Accounting Software Review and Pricing

Table of Contents

Xero is our choice for the best accounting software for growing companies. Its service plans, features and integrations easily accommodate different stages of small business development and the changing needs accompanying business growth.

- Xero’s pricing plans aren’t based on user count, so you can add employees without worrying about software costs increasing.

- The software integrates with more than 1,000 business apps.

- Xero has a well-designed user interface and layout that make complex accounting statistics easy to understand.

- The lowest tier has caps on invoicing and bills, which means many businesses will need to upgrade to a more expensive plan.

- Invoice customization isn’t as intuitive as in competing programs.

Xero is our pick for the best accounting software for growing companies. Because its pricing plans are not based on employee numbers, Xero can easily accommodate various development stages and the changing small business accounting needs accompanying business growth. We recommend Xero for companies that are rapidly adding employees and don’t want to worry about the number of people at the organization using the product.

Xero Accounting Software Editor's Rating:

9.1 / 10

- Payments

- 9.0/10

- Automatic invoicing

- 9.0/10

- Third-party integrations

- 9.5/10

- Mobile app

- 9.0/10

- 24/7 customer support

- 9.0/10

Why We Chose Xero as the Best for Growing Businesses

New businesses typically begin as small operations. However, as a company grows, its financial needs change. Many business owners with a growth mindset prefer choosing an accounting software solution and sticking with it over the long haul. Compared to other software we reviewed, Xero stands out for meeting businesses’ needs in all growth phases.

Xero’s pricing structure is an excellent fit for growing businesses. Unlike many competitors, Xero’s pricing and plans are based on features instead of user numbers. In fact, all of Xero’s plans support unlimited users, which is great for expanding businesses. Xero also integrates with over 1,000 third-party business apps – among the most integrations of any accounting software package we reviewed. As a business moves into higher-growth phases, it will likely require more integrations to scale up and keep things running smoothly.

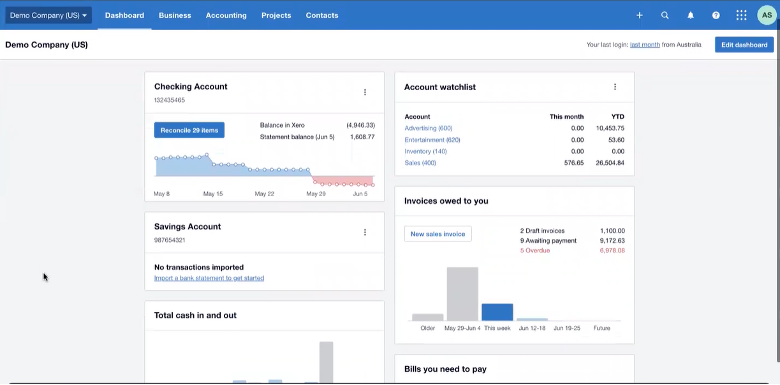

During our software testing, we found that Xero is ideal for business owners without much accounting knowledge. Even with all its features, Xero keeps it simple with a user-friendly interface and visualization to help customers who are new to running a business (see the screenshot from our demo below). For these reasons and more, Xero is our pick for the best accounting software for growing businesses.

Xero is considered a quality QuickBooks alternativex because of its mobile app availability, accounting and invoicing features, and international invoicing capabilities.

Business owners can track bank balances, invoices, bills and more from Xero’s main dashboard. Source: Xero

What We Like About Xero

- Xero’s pricing plans aren’t based on user count, so you can add employees without worrying about software costs increasing.

- The software integrates with more than 1,000 business apps.

- Xero has a well-designed user interface and layout that makes complex accounting statistics easy to understand.

What We Don’t Like About Xero

- The lowest tier has caps on invoicing and bills, which means many businesses will need to upgrade to a more expensive plan.

- Invoice customization isn’t as intuitive as in competing programs.

Ease of Use

When testing the software, we found Xero easy to navigate, with an intuitive and user-friendly interface. The main dashboard displays several key statistics business owners need at their fingertips, including how much money is in their business checking account, who owes them money, bills that must be paid and the current cash flow situation.

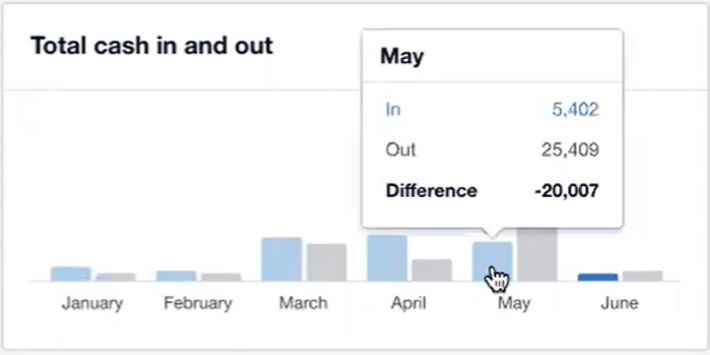

A bar at the top of the interface contains several drop-down menus that house Xero’s features. Like other major accounting packages, such as QuickBooks, Xero’s feature-packed interface can sometimes feel a bit overwhelming. However, compared to competitors we reviewed, Xero excels at presenting information in an easy-to-understand way. For example, Xero’s cash flow bar chart displays cash going out of the company as a gray line and cash coming in as a blue line. A business owner trying to maintain positive cash flow would look for the blue line to remain above the gray line (see the screenshot below for an example).

Additionally, we like that Xero avoids accounting jargon, such as “debits” and “credits,” throughout its interface, which is helpful because most business owners aren’t accountants or bookkeepers. Many other accounting software programs use accounting terminology, but Xero uses terms like “invoices owed” and “bills you need to pay.” This clear language makes the software easy for anyone to understand, even if you aren’t familiar with general ledger accounting.

Xero makes it easy to understand your business’s current cash flow situation. Source: Xero

Xero Features

Xero saves business owners time by streamlining processes and providing tools to accomplish financial tasks faster. Here are some of the must-have accounting software features Xero offers to make accounting less tedious:

Recurring Invoices

One cool feature is that Xero lets you schedule recurring invoices (or “repeating invoices”) by setting the send date, frequency and end date. Automatic payment reminders encourage customers to pay on time, saving you from following up and dealing with unpaid invoices. You can set the software to send reminders before the payment is due or when it’s past due; you can also set up the system to email your customers’ receipts after receiving and recording payments.

Online Invoicing

Except for a few minor inconveniences, we were impressed with Xero’s invoicing capabilities. Everything is done in the cloud, meaning you can edit invoices without the hassle of resending them to customers. You can email invoices directly from the software; Xero integrates with PayPal, Stripe, Square and other payment processors, so you can accept payments online.

However, we discovered a drawback: Customizing an invoice’s look and feel is slightly less intuitive than it is with competitors like FreshBooks, which specializes in generating invoices. A professional-looking invoice is essential for getting paid, so this is something to note for businesses that send out many invoices. That said, converting a quote to an invoice is straightforward, and invoices have drag-and-drop lines that make it easy to reorder items. Conveniently, you can attach files to invoices, such as a document or a photo of your completed work (see the screenshot below for an example of an invoice created using Xero during our demo).

If you decide to charge late fees or interest on an unpaid invoice, it’s crucial that your original contract clearly outlines that these charges may be assessed.

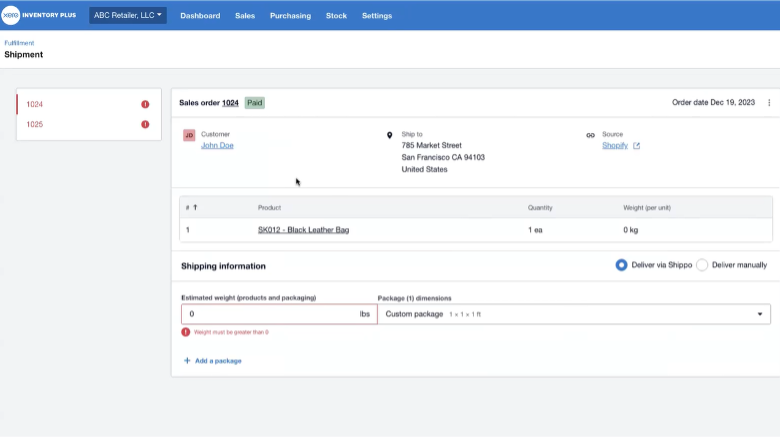

If your operation’s inventory needs are complicated, consider implementing one of the best POS systems, which have extensive inventory management tools.

Inventory Management

One cool new Xero feature is its beefed-up Inventory Plus management system. This system allows you to manage inventory across multiple locations and channels. It integrates with Shopify and includes order fulfillment functions, shipping options and tracking information. We think this new system will prove particularly useful for larger businesses with a big e-commerce presence.

Xero’s Inventory Plus features allow you to manage inventory across multiple locations and channels. Source: Xero

Transaction Monitoring

We really liked Xero’s unique History & Notes feature, which presents an activity report at the bottom of every transaction screen. This feature lets you monitor information about the document. For example, you can see if the invoice was copied from a quote, who created and approved it, and when they created and approved it. This screen also shows automatic payment reminder information, such as the relevant email address and the date and time. Additionally, you can add notes, such as the expected payment date.

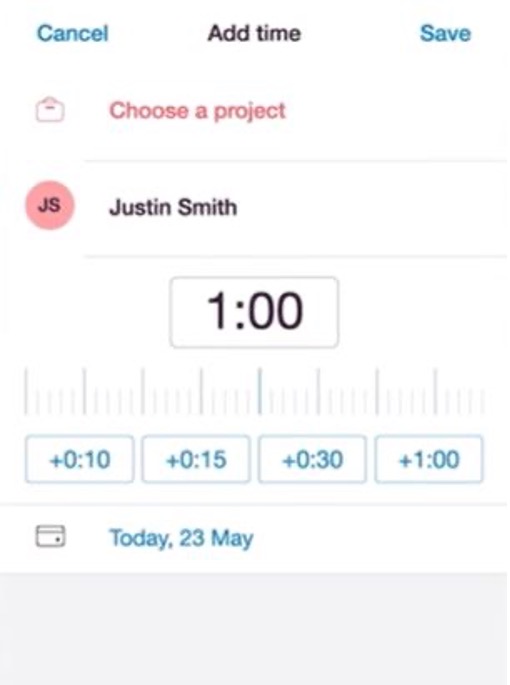

Time Tracking

We appreciate that Xero includes time tracking in all its plans (see the screenshot below from our demo). This contrasts with many alternatives, such as QuickBooks, that offer time tracking only on more expensive plans or as an add-on. Users are required to download the free Xero Projects app, which they can use to record time and costs and create invoices and reports. We especially like that this feature is free, although some stand-alone time-tracking apps include additional functionality.

Xero doesn’t charge extra for its time-tracking tools. Source: Xero

Reports

Big data is changing businesses, affecting operations more each year. Growing businesses need data presented in an easily digestible manner so business owners can act on the insights. During our software demo, we found that Xero’s reporting features can help you make sense of the data analytics at your disposal. Xero’s reporting tool distills your accounting data into easily digestible bar charts, pie charts and other graphs. A few popular tools include your business’s top 10 customers, Xero’s budget manager and the ability to drill down into your best revenue generators. Xero also allows you to export multiple reports.

Xero also capably generates profit and loss statements, trial balance reports, balance sheets, and other traditional accounting reports.

Security

Xero connects to your bank and credit card accounts and imports data daily, so we really appreciate that it protects your sensitive business data with bank-grade encryption. Additionally, you can opt in to two-factor authentication to make your login more secure. If you add employees to your account, you can set user permissions to control the data they can access.

Xero Pricing

Xero’s pricing compares favorably with other accounting software we reviewed. Popular alternatives, such as FreshBooks and QuickBooks Online, cost at least $18 monthly without introductory discounts. In contrast, Xero’s entry-level plan is slightly less expensive, at $15 per month.

Xero’s tiered pricing plan makes it ideal for growing businesses. We like that all Xero plans include nearly every available feature, including estimates, accounts payable and inventory management tools. With some other accounting software we reviewed, these features are available only in the top-tier plans. However, there are three features available only in Xero’s top tier: expenses, multicurrency support and project tracking.

Unlike many other accounting applications, Xero does not base its pricing on the number of individuals who need access. With every Xero plan, there is no limit on the number of users. In our view, this is one of Xero’s key differentiating factors, making it a great choice for growing businesses that are rapidly adding new employees.

Additionally, Xero offers a 30-day free trial, so you and your employees can test the software before you buy it. Not every accounting software provider offers a free trial, so we appreciate this feature.

Here’s a breakdown of each Xero plan:

- Early: This plan costs $15 monthly and limits you to 20 invoices and five bills per month. It also includes access to Hubdoc.

- Growing: This plan costs $42 monthly and includes everything in the Early plan, plus unlimited invoices, bills and bank transactions.

- Established: The highest-tier plan costs $78 monthly. In addition to everything in the Early and Growing plans, the Established plan includes expenses and projects and can handle multiple currencies.

Xero partners with Gusto to add more HR functions, such as payroll services. With Gusto, you can onboard new hires, administer employee benefits, track hours and paid time off, run payroll, and automatically file payroll taxes. The monthly base price is $40 plus $6 per person.

Read our comprehensive review of Gusto to learn more about the features and capabilities of this robust HR solution.

Implementation and Onboarding

During our test run of Xero, we found it easy to set up. New users can access a free 30-day trial, which doesn’t require a credit card for sign-up. We liked that the trial version of Xero is full-featured, meaning you can test it out with real data. This gives Xero an edge over competitors that don’t offer such generous terms.

Once you sign up, Xero provides several guided tutorials to acquaint you with its tools, such as connecting your business bank account, adding customers and creating invoices. Many pages within the app have how-to videos and links to a step-by-step guide, which is great for business owners who aren’t very tech-savvy.

Customer Service

In general, we were pleased with Xero’s customer support options. However, they were not as comprehensive as what we found in our review of QuickBooks Online. Phone support is not available immediately; you must contact customer service first via email or live chat. However, the upside is that Xero does not leave users hanging with long wait times. Instead, the company will call you back at a time convenient for you.

The system seems to work for most customers. Xero’s customer service scores 4.3 out of 5 on Trustpilot, with many users praising the fast response time. This is ideal for growing businesses that don’t want to waste time on technical issues.

In addition to reaching out for live help, you can access valuable online support resources, including videos, a blog, podcasts, small business guides and training courses. Xero recently streamlined the ability to search for help while using the software, so you don’t have to leave the site.

Xero provides unlimited online support with a callback option. Source: Xero

Limitations

Xero is an excellent accounting solution. However, we did encounter some limitations:

- Cap on invoicing and billing: One limitation of Xero compared to alternatives is the cap on invoicing and billing for its lower-tier plans. The Early plan allows you to send only 20 invoices and five bills a month, which we found unusually low. As a point of comparison, FreshBooks lets you send unlimited invoices to five customers on its lowest-tier plan. Users will need Xero’s higher-tier plans to remove these caps.

- Expense tracking: The Early and Growing plans don’t offer expense tracking. You’ll have to upgrade to the Established plan for this feature.

- Niche limitations: Although Xero offers a comprehensive set of features, it may not appeal to businesses with niche requirements. Businesses that must track time for billable hours or send invoices on the spot should read our FreshBooks review, while those focused on enterprise resource planning (ERP) might appreciate our review of Oracle NetSuite.

- Accounts payable limitations: Xero also lacks the comprehensive vendor network that would make it an effective player in the accounts payable space. Processing accounts payable is a vital part of running a business, so small business owners may want to consider software that supplements Xero’s capabilities.

Free software, such as Melio, can supplement Xero for your accounts payable needs, including automating accounts payable.

Methodology

We researched and analyzed dozens of the best accounting and invoicing software solutions to help small businesses choose the right accounting software for their needs. To generate our quantitative score and use case, we reviewed software features such as payment and invoicing capabilities, integrations, mobile apps, report generation, supported user count, and customer service options. We also assessed pricing and the availability of free trials. Our information sources included the company’s website and software demos. Additionally, we studied user reviews for independent opinions on the software’s pros and cons. When looking for the best accounting software for growing businesses specifically, we focused on pricing tiers, the number of integrations, and the breadth of features and tools. You can read more about our editorial process here.

Xero FAQ

Xero is an accounting software package designed to help small businesses manage their finances. It offers bookkeeping, invoicing, business analytics and more.

Whereas QuickBooks is the market leader in the U.S., Xero holds a major market share in countries such as Australia. Both software packages offer many features and integrations, but Xero is slightly less expensive and allows unlimited users.

Xero features a user-friendly interface and avoids confusing accounting jargon, making it an excellent choice for users who are not tech-savvy or who do not have deep knowledge of accounting.

Bottom Line

We recommend Xero for …

- Growing businesses that are rapidly adding employees.

- Businesses that need their accounting software to integrate with many different third-party apps.

- Less accounting-savvy business owners who prefer lots of color-coded visuals to help them analyze their business’s performance.

We don’t recommend Xero for …

- Businesses that need a low-cost way to send many invoices or bills.

- Niche businesses (such as those in e-commerce) that require more specialized solutions instead of a mass-market, one-size-fits-all software package.