MENU

Starting a Business

- Best Small Business Loans

- Best Business Internet Service

- Best Online Payroll Service

- Best Business Phone Systems

Our Top Picks

- OnPay Payroll Review

- ADP Payroll Review

- Ooma Office Review

- RingCentral Review

Our In-Depth Reviews

Finance

- Best Accounting Software

- Best Merchant Services Providers

- Best Credit Card Processors

- Best Mobile Credit Card Processors

Our Top Picks

- Clover Review

- Merchant One Review

- QuickBooks Online Review

- Xero Accounting Review

Our In-Depth Reviews

- Accounting

- Finances

- Financial Solutions

- Funding

Explore More

Human Resources

- Best Human Resources Outsourcing Services

- Best Time and Attendance Software

- Best PEO Services

- Best Business Employee Retirement Plans

Our Top Picks

- Bambee Review

- Rippling HR Software Review

- TriNet Review

- Gusto Payroll Review

Our In-Depth Reviews

- Employees

- HR Solutions

- Hiring

- Managing

Explore More

Marketing and Sales

- Best Text Message Marketing Services

- Best CRM Software

- Best Email Marketing Services

- Best Website Builders

Our Top Picks

- Textedly Review

- Salesforce Review

- EZ Texting Review

- Textline Review

Our In-Depth Reviews

Technology

- Best GPS Fleet Management Software

- Best POS Systems

- Best Employee Monitoring Software

- Best Document Management Software

Our Top Picks

- Verizon Connect Fleet GPS Review

- Zoom Review

- Samsara Review

- Zoho CRM Review

Our In-Depth Reviews

Business Basics

- 4 Simple Steps to Valuing Your Small Business

- How to Write a Business Growth Plan

- 12 Business Skills You Need to Master

- How to Start a One-Person Business

Our Top Picks

Looking for more options?

Check out The Best Accounting and Invoice-Generating Software for 2024 business.com recommends.

FreshBooks Accounting Software Review and Pricing

Table of Contents

FreshBooks is our choice for the best accounting software for invoicing. It has extensive features that allow businesses to manage clients and projects, track time, create and send invoices, accept online invoice payments, and more.

- FreshBooks offers customized, branded invoices that can be sent at specified intervals.

- It's easy to track time and send invoices via the FreshBooks mobile app.

- FreshBooks has robust project management features that are ideal for service-based businesses.

- The FreshBooks mobile app can't generate reports on the go.

- FreshBooks offers few inventory management features.

- There are no batch-invoicing shortcuts.

business.com

Looking for more options?

Check out The Best Accounting and Invoice-Generating Software for 2024 business.com recommends.

Invoicing is one of the most crucial small business accounting tasks, helping business owners manage cash flow and all elements of payment tracking. FreshBooks is an ideal accounting solution for small businesses that generate numerous invoices. With FreshBooks, you can create professional invoices in seconds, track and bill expenses, send automatic reminders, produce various reports, and much more. For these reasons, FreshBooks is our choice for the best accounting software for invoicing.

FreshBooks Accounting Editor's Rating:

9.1 / 10

- Payments

- 9.5/10

- Automatic invoicing

- 9/10

- Third-party integrations

- 9.5/10

- Mobile app

- 8.5/10

- 24/7 customer support

- 9/10

Why We Chose FreshBooks as the Best for Invoicing

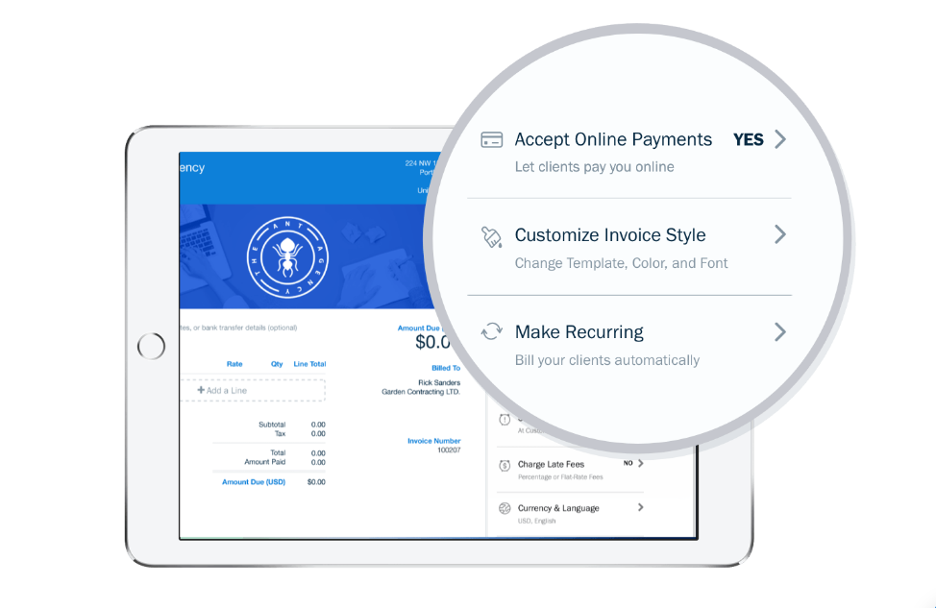

When we tested FreshBooks, we found that it offers all of the essential accounting features that small businesses need. However, we were particularly impressed by the software’s invoicing capabilities, which we discovered are far superior to those of many competitors we reviewed. We tested the software extensively and found creating and sending professional invoices straightforward and effortless. FreshBooks lets you set up recurring invoices, schedule automatic payment reminders, and accept credit and debit card payments online – features that can help a small business head off cash flow problems.

We like that FreshBooks monitors an invoice’s status after you send it, showing you when customers receive and view invoices. It tracks billable time and expenses and allows you to add them to invoices – a feature lacking in many competitors we also tested. This capability makes FreshBooks an excellent option for freelancers, self-employed professionals, and agencies and firms that provide professional services. All of these benefits and more make FreshBooks our top choice for businesses that need robust invoicing abilities with their accounting solution.

If you’re looking for a free alternative to FreshBooks with capable accounting features, consider Wave Accounting.

FreshBooks helps businesses customize invoices, create recurring invoices and accept payments online. Source: FreshBooks

Ease of Use

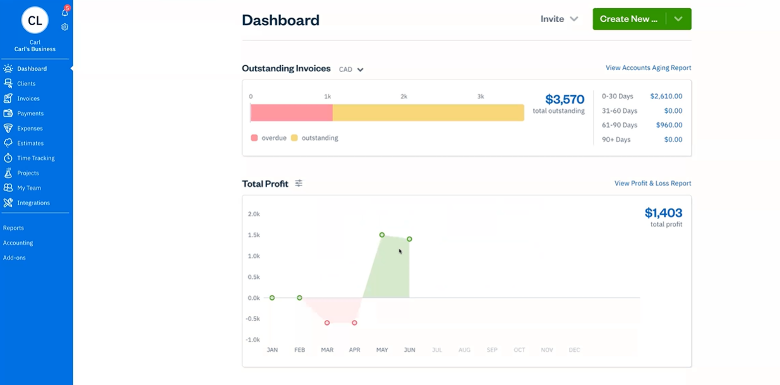

Business owners aren’t usually accountants or bookkeepers, so they need a straightforward accounting solution. One of our favorite things about FreshBooks is its ease of use. After testing FreshBooks ourselves, we’re confident business owners will have no trouble navigating and learning the software. The user interface is attractive and clearly labeled (see the screenshot below from our demo). A central dashboard displays vital business information and statistics, including unpaid invoices, profit, revenue and expenses. Unlike on some competing software we tried, the main dashboard widgets are fixed, although the information displayed within them can be customized.

On the left side of the screen, you’ll find a menu of the program’s primary categories. Each feature’s individual screen is well designed for simplicity and user-friendliness, with color-coded buttons and text that help direct the user’s attention.

The FreshBooks dashboard is clean and easy to navigate. Source: FreshBooks

Features

FreshBooks has several must-have accounting software features to make your accounting tasks easier and faster to complete, along with top-notch invoicing tools. Here’s a rundown of the functions we found the most compelling during our hands-on investigation.

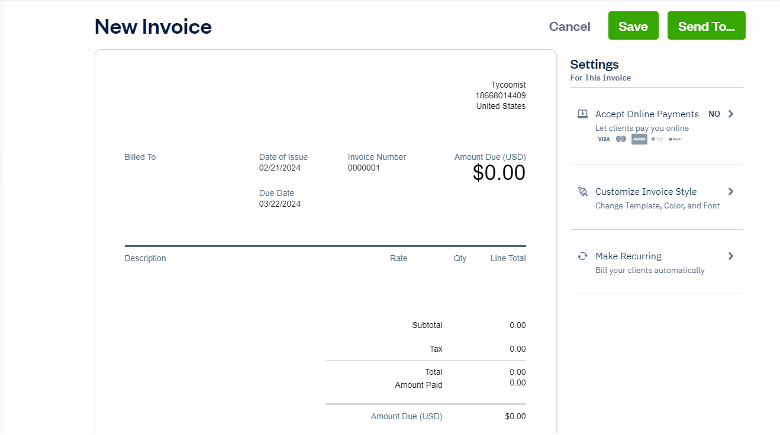

Custom Invoicing

A professional-looking small business invoice is essential for getting paid. We love that FreshBooks allows you to quickly customize the look of your invoices to match your company’s branding. You can easily upload your logo and then choose a template, font and accent color. We like that you can also customize your payment terms, add a note to your customer, request a deposit and create a payment schedule.

We were also impressed that FreshBooks lets you convert estimates and proposals to invoices in two clicks. Additionally, we found it easy to duplicate and modify past invoices instead of creating new ones from scratch. Based on our years of testing accounting software, we believe FreshBooks’ invoicing features surpass those of competitors such as Xero and QuickBooks, which aren’t as intuitive.

FreshBooks’ invoicing tools make it easy to bill clients and get paid. Source: FreshBooks

Time Tracking

One of the coolest FreshBooks features we found is the time-tracking tool in the mobile app. With this function, contractors can add billable time to an invoice on the spot, enabling them to bill a customer on-site. Additionally, you can easily add billable expenses to invoices instead of using clunky manual methods, such as tracking time on a separate sheet of paper or a spreadsheet. To us, this tool solidifies the software’s superior invoicing capabilities.

Payments

We like that the FreshBooks Payments integration can sync to a PayPal or Stripe account, allowing users to track payments through FreshBooks. (Read our review of Stripe to learn more.) You can email invoices and receive updates when your clients view and pay them. Your customers can click a button on the invoice to pay it, thus eliminating the time it would take for paper invoices to arrive in the mail and helping you get paid faster. This is a crucial feature for getting paid quickly, and many rival accounting solutions we evaluated don’t offer it.

FreshBooks also integrates with Square for payments. Read our Square vs. Stripe comparison if you need help deciding on a payment solution.

Recurring Invoices

During our demo, we noticed FreshBooks’ ability to schedule recurring invoices to go out weekly, monthly, annually or as frequently as you choose. You can send automatic payment reminders before or after the due date to encourage customers to pay their bills promptly. We like that you can even set up the software to automatically charge interest and late fees on past-due invoices as either a percentage or a flat fee.

Mobile App

We were impressed with the FreshBooks mobile app, which is available for iOS and Android devices. The app assists with time tracking and on-the-spot invoicing; you can create invoices immediately after meeting with a client. You can also use the app to capture receipts, chat with customers and check the status of an invoice. The FreshBooks Accounting app is rated 4.7 out of 5 on the Apple App Store, indicating a high degree of customer satisfaction. We were similarly satisfied with it during our testing.

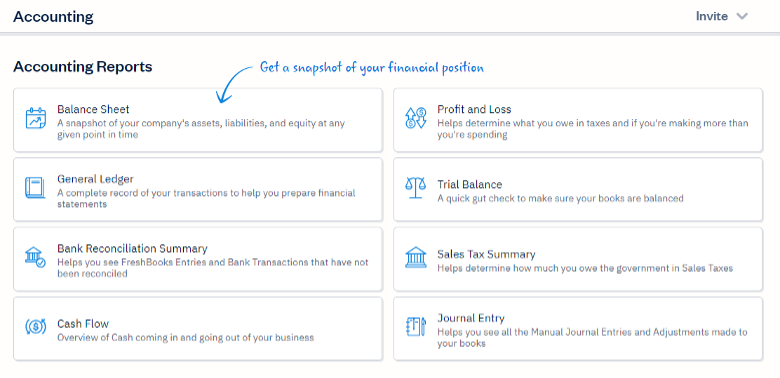

Accounting and Bookkeeping

Like other popular accounting software, FreshBooks connects to your business checking account and credit card accounts and automatically imports your expenses daily. The Premium and Select plans, which you can learn more about below, use double-entry accounting, allowing you to create a chart of accounts and run new reports, such as a general ledger report, a balance sheet and a trial balance. (See the screenshot below of FreshBooks’ accounting reports dashboard below.)

More recently, FreshBooks added tools we think accountants in particular will appreciate, including the ability to close out retained earnings and more customization around income mapping.

You can handle all of your accounting reports needs right from the FreshBooks accounting dashboard. Source: FreshBooks

Project Management

We appreciate FreshBooks’ project management tools, which allow you to manage projects and base your billing on an hourly or flat rate. A time budget shows how much time remains on a project, how much of your tracked time is unbilled and how many days are left until the project’s due date. You can also monitor how many hours your team members spend on each project, as well as share files and discuss the project. Unlike competitors QuickBooks and Xero, FreshBooks’ project management tools are available for all plans.

Reports

During our demo, we tested FreshBooks’ ability to generate various reports, including profit and loss statements, sales tax summaries, accounts receivable aging, expense reports, invoice details, payments collected, and time-entry details. The process was simple and smooth, and we like that you can email, print or export these reports to Excel. Be sure to take advantage of these – the reporting tools provide small business owners with valuable data analytics and insights into their businesses.

User Permissions

User permissions are critical for preventing employee accounting fraud, and we were happy to see that FreshBooks includes this feature. You can invite business partners, employees, contractors and accountants to your account, but they can view only what you allow them to access. For example, employees can access their projects, tracked time and expenses. Contractors can view only projects that you allow them to see, and they can track time spent on those projects. Accountants can see your dashboard, reports, expenses and invoices, but they can’t create invoices.

If you’re considering hiring a CPA as tax time approaches, evaluate your tax situation’s complexity, your business budget and your timetable. If you can afford to hire a CPA, it’s probably your best option.

Bank Reconciliation

We like that FreshBooks includes bank reconciliation tools so you won’t have to manually reconcile your business bank account. Transactions feed in automatically, meaning FreshBooks offers continuous reconciliation rather than end-of-month reconciling – a feature not offered by other competitors we reviewed. You can also manually add transactions through a CSV file, as well as search for unreconciled transactions.

Pricing

FreshBooks is on the higher end of the price spectrum compared with other accounting software solutions we reviewed. However, the vendor regularly offers discounts, so be sure to ask about introductory offers before you purchase any of the packages.

FreshBooks currently has four plans based on a business’s number of clients, with the lowest tier ideal for basic invoicing to a few clients. Here is a breakdown of the plans and their monthly rates without discounts:

- Lite: The Lite plan costs $19 monthly for up to five billable clients. You can connect the software to your bank account, track time and accept invoice payments online. There’s no limit to the number of estimates and invoices you can send, and you receive free access to the FreshBooks mobile app.

- Plus: This plan costs $33 monthly for up to 50 clients. With this tier – which FreshBooks says is its most popular plan – you can charge late fees and send recurring invoices, automatic payment reminders and proposals. You can run financial reports, including double-entry accounting reports for your general ledger, trial balance and chart of accounts. With this plan, there’s no additional user fee to invite your accountant to collaborate.

- Premium: The Premium plan costs $60 monthly and supports unlimited clients. This level includes everything in the Plus plan, along with more reporting and client-tracking capabilities.

- Select: The Select plan is best suited to large businesses. This package includes more personalized attention from FreshBooks staff, including a dedicated account manager, a dedicated customer support number and custom onboarding. Pricing is customized, so you’ll need to speak with a sales agent who can give you a quote for your specific needs.

Here are some additional fees and payment notes to be aware of:

- If you pay for FreshBooks annually instead of monthly, you can save 10 percent.

- Each additional user costs $11 monthly. This applies to business partners, contractors and employees you add to your account.

- FreshBooks Payments, which allows you to accept credit cards online, costs 2.9 percent plus $0.30 per transaction. Alternatively, you can connect your Stripe account to the system.

- Advanced Payments, an add-on service that gives you a virtual terminal that lets you accept payments by phone and in person, costs $20 per month on top of 3.5 percent plus $0.30 per transaction. Your clients can authorize recurring payments when you have this add-on.

We love that FreshBooks provides a generous 30-day free trial, which allows you to sample all of the program’s features before subscribing to a paid plan. Not all accounting software companies have a free trial, so we were impressed by this offer.

Implementation and Onboarding

We tested FreshBooks’ onboarding process, and we found it extremely easy to set up the software. As mentioned, there’s a generous 30-day free trial period, and, impressively, no credit card is required to open a trial account. You simply enter your email address, create a password and click a link in a confirmation email to get started. After the free trial ends, you must select a paid plan to continue using the software. Your data from the free trial will be stored until you decide to upgrade.

Like other accounting software we reviewed, FreshBooks is 100 percent cloud-based, so there isn’t any desktop software to install. You can also access FreshBooks from a mobile app. However, this also means an internet connection is necessary to use the software. As noted above, the Select plan comes with extra implementation and onboarding assistance via custom onboarding and an account manager.

Customer Support

Because many cloud-based software companies skimp on customer service, we were impressed that FreshBooks offers multiple support resources. We like that you can contact the company for help by phone (with a dedicated customer support number for Select subscribers), email or live chat, or search the online knowledge base for self-help. You can also access webinars, blog posts and free e-books that go into more depth about using the software. FreshBooks earns 4.3 out of five stars on Trustpilot, with 64 percent of users rating the customer service five stars.

The FreshBooks website features an automated chatbot that can assist with basic questions. During our test run, we found that the bot competently answered inquiries about pricing but struggled with more nuanced questions. Prospective customers with further questions can contact a sales representative by email or phone.

FreshBooks offers numerous online help resources for invoicing, new software features, reports, time tracking and more. Source: FreshBooks

Limitations

While FreshBooks excels at time tracking, general invoicing and project management, we found it lacking in several areas during our testing:

- Inventory tracking and vendor management: The software lacks the robust inventory tracking and vendor management features offered by similarly priced alternatives, such as what we found in our review of QuickBooks Online. Business owners with more complex inventory needs also might want to read our review of Xero, which recently beefed up its inventory automation features.

- Batch invoicing: Another missing feature is batch-invoicing shortcuts, which are useful if you must bill multiple customers for the same service at the same rate. This is an odd oversight for a solution that otherwise excels at invoicing.

- Mobile reports: The FreshBooks mobile app is excellent for invoicing. However, it doesn’t run reports, and we found generating reports on the go via a mobile browser to be rather clunky.

- Payments: To pay and receive payments via FreshBooks, you must use third-party integrations with services such as Stripe and PayPal, which means you must sign up for additional applications.

- Accounts payable: FreshBooks lacks the comprehensive vendor network that would make the software an effective player in the accounts payable space. Processing accounts payable is a vital part of running a business, so small business owners may want to investigate one of the best credit card processing solutions to supplement FreshBooks.

For more insight on how FreshBooks fares versus its rivals, see our direct comparison of FreshBooks and QuickBooks and our FreshBooks vs. Xero comparison.

If your business has complex inventory needs, check out the best POS systems, which typically have extensive inventory management tools.

Methodology

We researched and analyzed dozens of accounting and invoicing software solutions to help small businesses choose the right accounting software for their needs. We reviewed each product’s software features (such as payment and invoicing capabilities), integrations, mobile apps, report generation, supported user count and customer service options. We also assessed pricing and the availability of free trials.

We relied on vendors’ websites and personal demos when conducting our analysis so we could test the solutions ourselves. Additionally, we studied user reviews to get independent opinions on the software’s pros and cons. When looking for the best accounting software for invoicing specifically, we particularly focused on factors like ease of use for billing, invoice customization, and the ability to send an invoice on the spot and as a recurring item. You can read more about our editorial process here.

FAQ

FreshBooks can replace QuickBooks depending on your business needs. FreshBooks offers many of the same bookkeeping features as QuickBooks for a similar price, making it a worthy QuickBooks alternative to consider. It also focuses more on invoicing features, giving it an edge over QuickBooks in that area.

FreshBooks is used for cloud-based accounting. With FreshBooks, you can easily create and send invoices from a mobile device, track time and manage projects, among traditional accounting tasks.

We found FreshBooks easy to learn during our software test. FreshBooks’ user interface is very intuitive, with an easy-to-navigate dashboard that displays key statistics and makes it simple to access various features.

Bottom Line

We recommend FreshBooks for …

- Business owners who want a simple alternative to old-fashioned, manual methods of tracking billable hours.

- Businesses that want to frequently send branded, customized or recurring invoices.

- Businesses that focus on services instead of physical goods.

We don’t recommend FreshBooks for …

- Businesses that carry a lot of inventory or have complex inventory needs.

- Business owners who want their accounts payable and bookkeeping all in one software package.

- Business owners who want to run reports on their mobile devices.

business.com

Looking for more options?

Check out The Best Accounting and Invoice-Generating Software for 2024 business.com recommends.