MENU

Starting a Business

- Best Small Business Loans

- Best Business Internet Service

- Best Online Payroll Service

- Best Business Phone Systems

Our Top Picks

- OnPay Payroll Review

- ADP Payroll Review

- Ooma Office Review

- RingCentral Review

Our In-Depth Reviews

Finance

- Best Accounting Software

- Best Merchant Services Providers

- Best Credit Card Processors

- Best Mobile Credit Card Processors

Our Top Picks

- Clover Review

- Merchant One Review

- QuickBooks Online Review

- Xero Accounting Review

Our In-Depth Reviews

- Accounting

- Finances

- Financial Solutions

- Funding

Explore More

Human Resources

- Best Human Resources Outsourcing Services

- Best Time and Attendance Software

- Best PEO Services

- Best Business Employee Retirement Plans

Our Top Picks

- Bambee Review

- Rippling HR Software Review

- TriNet Review

- Gusto Payroll Review

Our In-Depth Reviews

- Employees

- HR Solutions

- Hiring

- Managing

Explore More

Marketing and Sales

- Best Text Message Marketing Services

- Best CRM Software

- Best Email Marketing Services

- Best Website Builders

Our Top Picks

- Textedly Review

- Salesforce Review

- EZ Texting Review

- Textline Review

Our In-Depth Reviews

Technology

- Best GPS Fleet Management Software

- Best POS Systems

- Best Employee Monitoring Software

- Best Document Management Software

Our Top Picks

- Verizon Connect Fleet GPS Review

- Zoom Review

- Samsara Review

- Zoho CRM Review

Our In-Depth Reviews

Business Basics

- 4 Simple Steps to Valuing Your Small Business

- How to Write a Business Growth Plan

- 12 Business Skills You Need to Master

- How to Start a One-Person Business

Our Top Picks

Table of Contents

Today’s businesses must accept credit cards and digital payment methods to accommodate customers’ needs and preferences. However, choosing a credit card processor can seem daunting. You need affordable pricing, robust security measures and appropriate features and integrations to ensure seamless operations.

Stripe and Square are among the best credit card processors small businesses should consider. We’ve researched both platforms to help you compare them side by side and determine if one or the other would be an ideal payment processing solution for your organization.

Editor’s note: Looking for the right credit card processor for your business? Fill out the below questionnaire to have our vendor partners contact you about your needs.

Stripe vs. Square Highlights

Stripe and Square are third-party payment processors that help businesses accept credit and debit cards and digital payment methods like Apple Pay. Both are Payment Card Industry (PCI)-compliant ― an essential security feature for all merchants. Still, these platforms have distinct differences that may make one or the other more suitable for your business. Here’s an overview of how they compare.

Feature | Stripe | Square |

|---|---|---|

Best for | E-commerce businesses and web developers | Brick-and-mortar and multichannel businesses |

Pricing | No monthly fees; 2.9% plus 30 cents per online transaction; 2.7% plus 5 cents per in-person transaction | $0 to $72 monthly fee; 2.9% plus 30 cents per online transaction; 2.6% plus 10 cents per in-person transaction |

Third-party integrations | Hundreds, including QuickBooks, Amazon Web Services and NetSuite | More than 350, including QuickBooks, Wix and DoorDash |

Hardware | BBPOS Chipper 2X BT mobile and BBPOS WisePOS E terminal | Square mobile reader, Square Terminal and Square POS Register |

Payment methods | Online checkout, virtual terminal, Apple Pay and Google Pay | Online checkout, virtual terminal, invoicing, POS hardware, Apple Pay, Google Pay, Cash App and automated clearing house (ACH) |

Customer service | 24/7 support by phone, chat and email | Phone, chat, social media and email; self-help resources |

Who Is Stripe For?

Stripe is an ideal solution for e-commerce businesses with in-house web developers. It’s also an excellent option for mobile commerce, subscription as a service, marketplace and platform businesses. Tech-savvy business owners will likely enjoy customizing the platform to their unique needs. Our comprehensive Stripe review explains more about the solution’s options, features and best use cases.

Who Is Square For?

Square is an excellent option for multichannel or brick-and-mortar businesses, particularly in the retail, personal care and restaurant industries. Additionally, Square’s robust free plan makes it an ideal solution for low-volume or seasonal businesses. Read our in-depth review of Square to learn more about this vendor’s features and capabilities.

Square also offers a service called Square Online that provides a free web hosting tier for new online stores. It includes a free SSL certificate and a website builder with SEO tools.

Stripe vs. Square Service Comparisons

Here’s a closer look at each platform’s core elements and how they stack up against each other.

Plans and Pricing

Stripe

Stripe’s Standard plan is designed for smaller businesses and has no setup or monthly fees. (The vendor also offers a customized plan for merchants with unique business models and high payment volumes.)

Standard plan features include the following:

- Embeddable checkout

- Custom user interface (UI) toolkit

- Simplified PCI compliance

- Invoice support

- Ability to process payments in more than 135 currencies and local payment methods

- Real-time reporting

Stripe features an interchange-plus pricing model, charging a percentage of the transaction over the credit card company’s interchange rate, plus a small flat fee. The type of charge dictates the costs as follows:

Type of charge | Cost |

|---|---|

Online domestic card charge | 2.9% plus 30 cents for each transaction |

In-person payments through a virtual terminal | 2.7% plus 5 cents for each transaction |

ACH payments | 0.8% with a $5 cap |

Digital wallet payments (Google Pay, Apple Pay, Click to Pay, WeChat Pay and Alipay) | 2.9% plus 30 cents for each transaction |

Invoicing | 0.4% per paid invoice for Starter or 0.5% for Plus |

Afterpay | 6% plus 30 cents for each transaction |

International card payments | An additional 1% fee, plus another 1% if currency conversion is required |

Stripe’s invoicing tool makes it easy to accept recurring payments and scheduled billing, making Stripe a great option for companies that operate on a subscription business model.

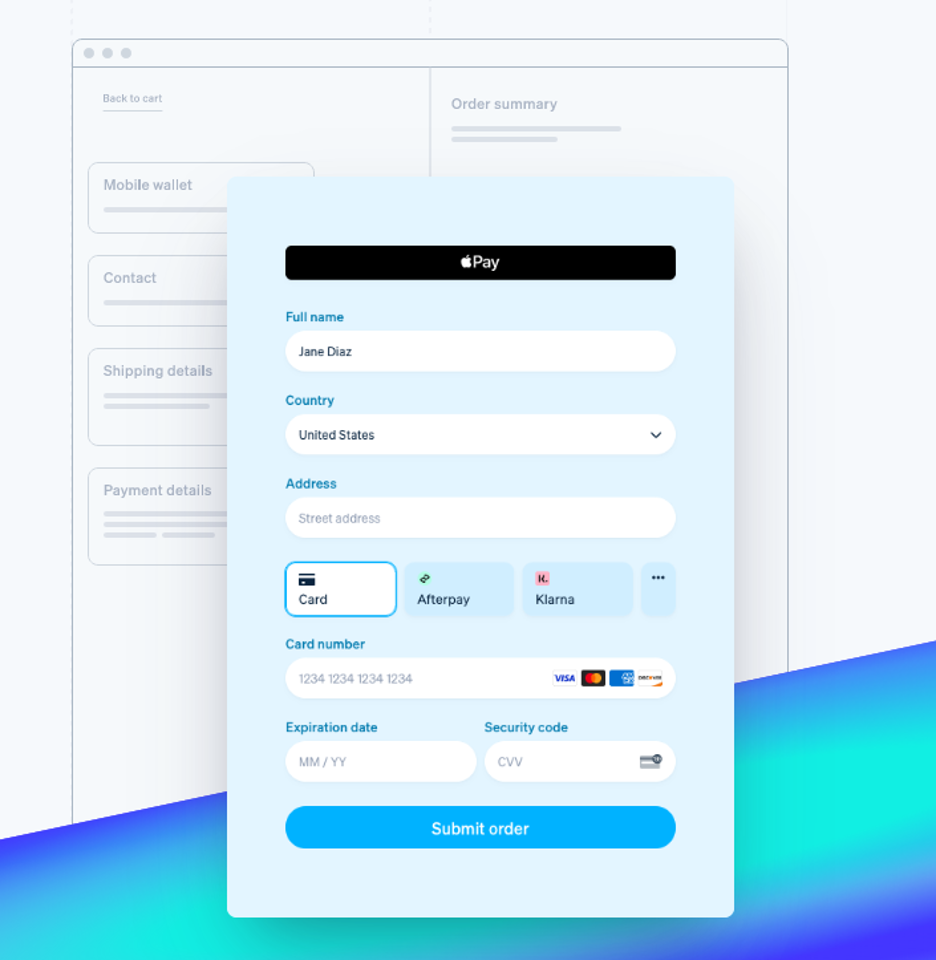

Stripe’s custom UI building blocks help e-commerce merchants create secure payment forms. Source: Stripe

Square

Square has several plans that accommodate businesses of varying sizes with different needs. We were particularly impressed by its free plan ― an ideal option if you’re just starting a business or your company has a low sales volume. (The monthly fees below reflect a discount for annual billing.)

Service plan | Monthly fee | Per-transaction rates | Features |

|---|---|---|---|

Free | $0 | 2.6% plus 10 cents (in person); 2.9% plus 30 cents (online); 3.5% plus 15 cents (manually entered) |

|

Plus | $29 | 2.6% plus 10 cents (in person); 2.9% plus 30 cents (online); 3.5% 15 cents (manually entered) | Everything in the Free plan, plus:

|

Premium | Custom priced | 2.6% plus 10 cents (in person); 2.9% plus 30 cents (online); 3.5% 15 cents (manually entered) | Customized features |

Square allows you to accept all major credit cards, PayPal, mobile wallets like Apple Pay and Google Pay and its proprietary digital wallet, Square Pay. Additionally, Square offers various add-on services that can help you automate email marketing campaigns and run text message marketing campaigns.

Before committing to a service, you should have a clear idea of how credit card processing fees work so you know precisely what you’re paying for.

Winner

Stripe wins this round. We like its no-nonsense plan and pricing without monthly fees. However, Square will likely appeal to merchants who need advanced functionality, like accepting PayPal or accessing Square’s various add-ons, including email marketing.

Payment Processing

Stripe

- Designed for e-commerce: Stripe focuses on e-commerce transactions. To ensure everything runs smoothly, Stripe provides a host of developer resources for integrating its payment platform into your e-commerce site.

- Virtual terminal available: Stripe also provides a virtual terminal. This web-based interface, Stripe Terminal, allows you to accept cards in person by keying in card information manually. In addition to credit and debit cards, Stripe Terminal accepts Apple Pay and Google Pay. Transactions processed through Terminal are integrated with your online transactions for reporting purposes, so you can see all your transactions in one place.

- Fast payout process: Stripe sales revenue will arrive in your business bank account on a two-day rolling basis. If you prefer, you can set up weekly or monthly batches.

- Low chargeback fee: Stripe has a relatively low chargeback fee of $15, which is fully refundable if the customer’s bank resolves the dispute in your favor.

Square

- Accept payments in various ways: Square gives merchants multiple ways to accept payments, including online, invoicing, hosted checkout payment pages, point-of-sale (POS) systems and virtual terminals.

- Multiple customer payment types accepted: In addition to major credit cards, you can accept digital payment methods like Apple Pay, Google Pay, Cash App, Samsung Pay and ACH for invoices.

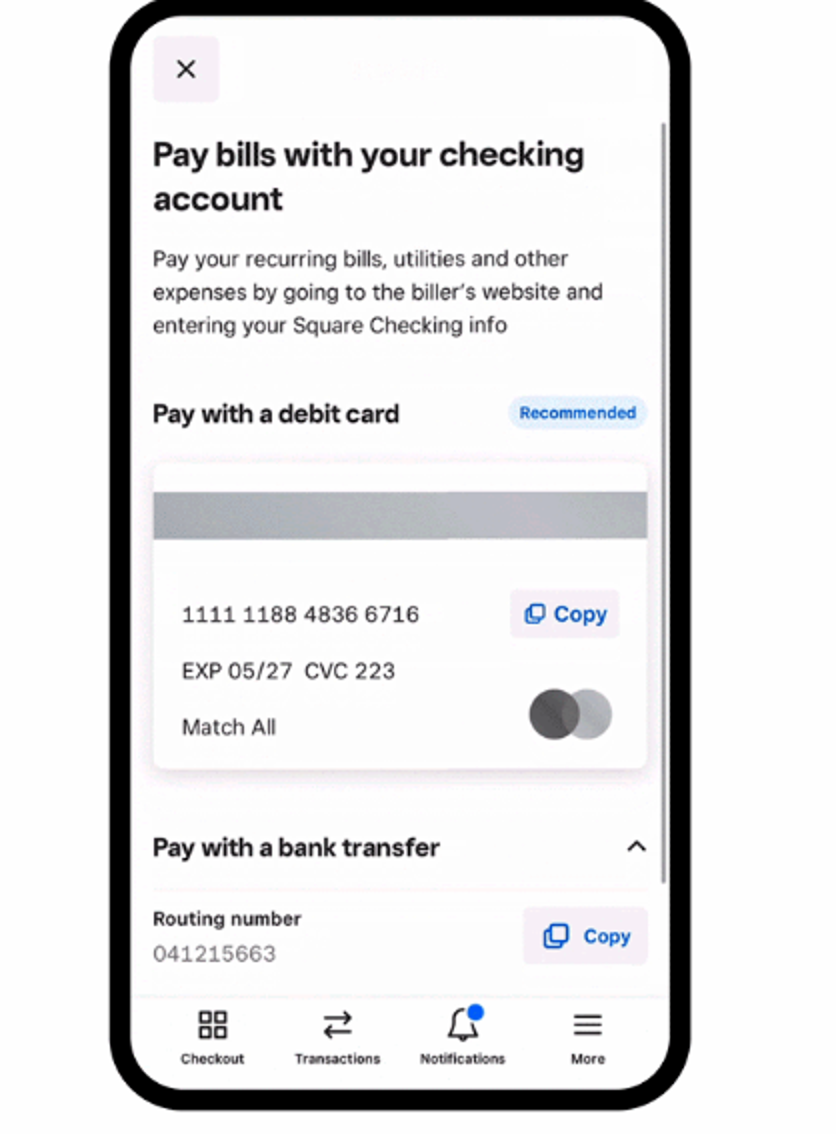

- Speedy payouts: Square holds your sales revenue in a Square Checking account. You can then transfer the money to another bank within a day. If you need it instantly, you can get it for a fee.

Square has no chargeback fees and, in a dispute, will represent you with the issuing bank.

Use your Square Checking account to pay bills, utilities and other expenses. Source: Square

Winner

Square edges out Stripe in the payment and credit card processing category, offering more ways for your customers to pay. Square can also deliver money to your bank account sooner for free. However, we like that Stripe automatically transfers your money without the extra step of going into the app to move it every time.

Security

Stripe

Stripe includes several online payment security features in its Standard plan:

- 3D Secure: This authentication method verifies a customer’s identity before an online purchase.

- Card account updater: This feature updates expired or renewed card information automatically for saved customers, reducing declined charges.

- Radar adaptive acceptance: Stripe’s machine learning (ML) algorithms improve authorization rates in real-time, increasing sales by reducing declined transactions.

- Additional security features: Stripe has additional security features available that allow merchants to verify the authenticity of government-issued identification by matching photos ($1.50 per verification) or having customers key in their name, date of birth and other data and validating it against government and third-party databases (only available for Social Security numbers).

Stripe’s online identity verification technology can help prevent payment fraud. Source: Stripe

Square

- PCI-compliance: Square is PCI-compliant, encrypting customer payment information end to end. This ensures that none of your customers’ private information is stored on your servers or devices.

- Fraud prevention: Square’s card readers are EMV-compliant, which means they accept chips. This functionality can help decrease fraud incidents. Additionally, Square uses ML models to identify suspicious transactions.

Winner

We like that both platforms prioritize security and work to reduce credit card fraud. However, Stripe allows merchants to verify cardholder identities at the point of sale, making it the winner in the security category.

Software

Stripe

- Mobile app: Stripe offers a mobile app that allows you to search transactions, refund purchases and view sales and customer data. However, you can’t use this app to process transactions. You must use Stripe’s mobile Terminal software for on-the-go transactions.

- POS system compatibility: Stripe’s software is compatible with several third-party POS devices.

- Highly customizable: Stripe’s software is highly customizable, with a wide array of tools to tailor the platform to your needs.

Square software

- Multichannel sales oversight: Square’s software makes it easy for businesses that sell through multiple channels to see all their transactions in one interface.

- Supports multiple transaction types: Square lets you process individual transactions on your website, set up recurring transactions and even process multiparty transactions by adding a fee on top of third-party payments you process through your app.

- Website integration: Square can integrate with your website through dedicated developer tools or you can use Square Checkout, which redirects customers to a Square-hosted payment page.

- CRM functionality: Square offers full CRM functionality, allowing you to link purchases to customer profiles and inventory.

Winner

Square’s software wins this round. We like that it provides industry-specific POS software and tools for inventory tracking and staff and customer management.

Hardware

Stripe

- Card readers: Stripe offers users two card readers, the BBPOS Chipper 2X BT for $59 and the BBPOS WisePOS E for $249.

- Other devices: The Chipper is a mobile Bluetooth device while the WisePOS is a handheld card reader with a PIN pad and touchscreen.

Square

Unlike Stripe, Square designs and builds its own card processing hardware, including the following:

- Square Reader for Magstripe: The Square Reader for Magstripe easily plugs into Android and iOS devices. However, this version only accepts swipe credit and debit cards, not chip or near-field communication (NFC) cards. There is no cost for your first Square Reader for Magstripe.

- Square Reader for Contactless & Chip: The Square Reader for Contactless & Chip connects to your mobile phone or tablet via Bluetooth. You can use it to accept NFC mobile payments like Apple Pay and Google Pay, as well as credit and debit cards. It costs $49.

- Square Terminal: The Square Terminal connects to Square’s software by Bluetooth and can accept payments by swiping, tapping or inserting cards. It can also print receipts. The Square Terminal is $299.

- POS Register: For permanent locations, Square offers the POS Register. It has a cashier-facing screen and a customer-facing payment interface that can accept credit and debit cards. You can use it as a stand-alone device or combine it with accessories like a receipt printer ($299), handheld scanner ($119) and cash drawer ($249).

Square’s POS register has a cashier-facing screen and a customer-facing touchscreen and is preloaded with POS software. Source: Square

Winner

Square is the clear winner here, offering a variety of sleekly designed and functional hardware. Stripe has minimal hardware options and no POS solutions.

Integrations

Stripe

- Software integrations: Stripe integrates with QuickBooks and NetSuite.

- Developer tools: Since its strength is e-commerce, Stripe provides many tools to help developers integrate Stripe easily with merchant websites. This includes comprehensive testing tools, a developer dashboard and hundreds of platforms and extensions.

- Application programming interfaces (APIs): Stripe’s basic plan includes free APIs to help you customize your online selling and checkout experience. You’ll need a good web developer to take advantage of these tools, as they are not something a nontechie can handle.

Square integrations

Square offers hundreds of integrations that allow you to enhance the service’s functionality, including industry-specific integrations like the following:

- Retail: Shopventory, WooCommerce, BigCommerce, Wix and Shippo

- Beauty and personal care: Square Appointments, Jotform, Cognito Forms and IntakeQ

- Restaurants: Square KDS, Postmates, Kyoo, Homebase and QuickBooks Time

Other popular integrations include the following:

- GoDaddy

- Mailchimp

- Gift Up

- ZipRecruiter

- TapMango

Square’s App Marketplace houses hundreds of business apps that sync seamlessly with your Square account. Source: Square

Winner

Square wins this category. It has many more integrations than Stripe, making it a more versatile solution.

Customer Service

Stripe

Stripe provides 24/7 support by phone, chat and email. It also offers technical support via Discord.

Square

Square’s customer support team is available by phone, email, live chat and social media. However, our research found Square’s customer service record to be a bit spotty. For regular day-to-day operations, the systems seem to work well. However, when problems occur, some customers report trouble getting a satisfactory resolution.

Winner

For customer service, Stripe’s 24/7 access to support is the clear winner.

Approval and Setup

Stripe

- Approval process: Stripe is easy to apply for. Once approved, setup is reasonably easy for those with web developer skills. Stripe will not approve merchants in high-risk industries, including financial institutions, online gambling, securities brokers, cannabis dispensaries, cryptocurrencies, bill pay services, insurance providers and crowdfunding sites.

- No-code options: If you and your team aren’t highly technical, Stripe has a no-code option for payment links. With this option, your customers will be taken to a custom checkout page hosted by Stripe. Additionally, tech novices will find it easy to set up invoicing as a payment method.

- Custom integration options: Stripe offers custom integration for merchants without programmers who need web integration for an additional fee. Alternatively, Stripe can match you with a verified third party with prebuilt solutions to make it easier to integrate Stripe with your website without knowing how to code.

Stripe allows merchants to generate payment links to share with customers. Source: Stripe

Square

- Approval process: As with Stripe, Square’s online application can be completed quickly. Like Stripe, Square will not approve merchants in high-risk industries or seemingly innocuous businesses, such as membership clubs and direct marketing firms.

- Setup: Once approved, setting up Square is relatively straightforward. Setup time will depend on the functionality you require.

- Easy integration options: Services like Square Checkout do not require coding and are quick and seamless to set up. Prebuilt third-party solutions are also easy to set up. However, if your main revenue stream is online sales, you will likely need a web developer to get everything running smoothly.

Winner

Square wins in the approval and setup category because it provides better integration options for nontechnical merchants.

Stripe and Square aren’t a fit for businesses that need credit card processing for high-risk industries. If your business is considered high-risk, read our review of ProMerchant ― a processor that may be able to accommodate you.

Stripe vs. Square summary

- Square is best for brick-and-mortar or mobile in-person businesses because of its flexible, easy-to-use software and hardware.

- Square’s generous, feature-full free plan makes it a great option for low-volume and seasonal businesses.

- Stripe is ideal for e-commerce businesses because its robust security measures can protect you from fraud and excessive chargebacks and declines.

- Stripe is an excellent option for technically skilled business owners. Others will likely need a developer’s help to implement the platform.

FAQs

There isn’t a monthly charge for Square’s Free plan. Monthly fees for paid tiers start at $29.

While Stripe automatically transfers your sales revenue into your linked bank account every two days, you can proactively fund your Stripe account by transferring money from your bank account to pay for future refunds or chargebacks.

Yes. Stripe is an Amazon partner and processes a significant portion of Amazon’s transactions.

It depends. If your business mostly does business online, Stripe is a better choice. However, Square provides attractive customer-facing equipment and an outstanding POS system for brick-and-mortar retailers.

Square and Stripe charge the same processing fees for e-commerce transactions. However, Square’s fees are lower for in-person, card-present transactions. Stripe’s fees are lower for manually entered transactions.