MENU

Starting a Business

- Best Small Business Loans

- Best Business Internet Service

- Best Online Payroll Service

- Best Business Phone Systems

Our Top Picks

- OnPay Payroll Review

- ADP Payroll Review

- Ooma Office Review

- RingCentral Review

Our In-Depth Reviews

Finance

- Best Accounting Software

- Best Merchant Services Providers

- Best Credit Card Processors

- Best Mobile Credit Card Processors

Our Top Picks

- Clover Review

- Merchant One Review

- QuickBooks Online Review

- Xero Accounting Review

Our In-Depth Reviews

- Accounting

- Finances

- Financial Solutions

- Funding

Explore More

Human Resources

- Best Human Resources Outsourcing Services

- Best Time and Attendance Software

- Best PEO Services

- Best Business Employee Retirement Plans

Our Top Picks

- Bambee Review

- Rippling HR Software Review

- TriNet Review

- Gusto Payroll Review

Our In-Depth Reviews

- Employees

- HR Solutions

- Hiring

- Managing

Explore More

Marketing and Sales

- Best Text Message Marketing Services

- Best CRM Software

- Best Email Marketing Services

- Best Website Builders

Our Top Picks

- Textedly Review

- Salesforce Review

- EZ Texting Review

- Textline Review

Our In-Depth Reviews

Technology

- Best GPS Fleet Management Software

- Best POS Systems

- Best Employee Monitoring Software

- Best Document Management Software

Our Top Picks

- Verizon Connect Fleet GPS Review

- Zoom Review

- Samsara Review

- Zoho CRM Review

Our In-Depth Reviews

Business Basics

- 4 Simple Steps to Valuing Your Small Business

- How to Write a Business Growth Plan

- 12 Business Skills You Need to Master

- How to Start a One-Person Business

Our Top Picks

Fixed and Variable Expenses: What Do These Terms Mean?

Table of Contents

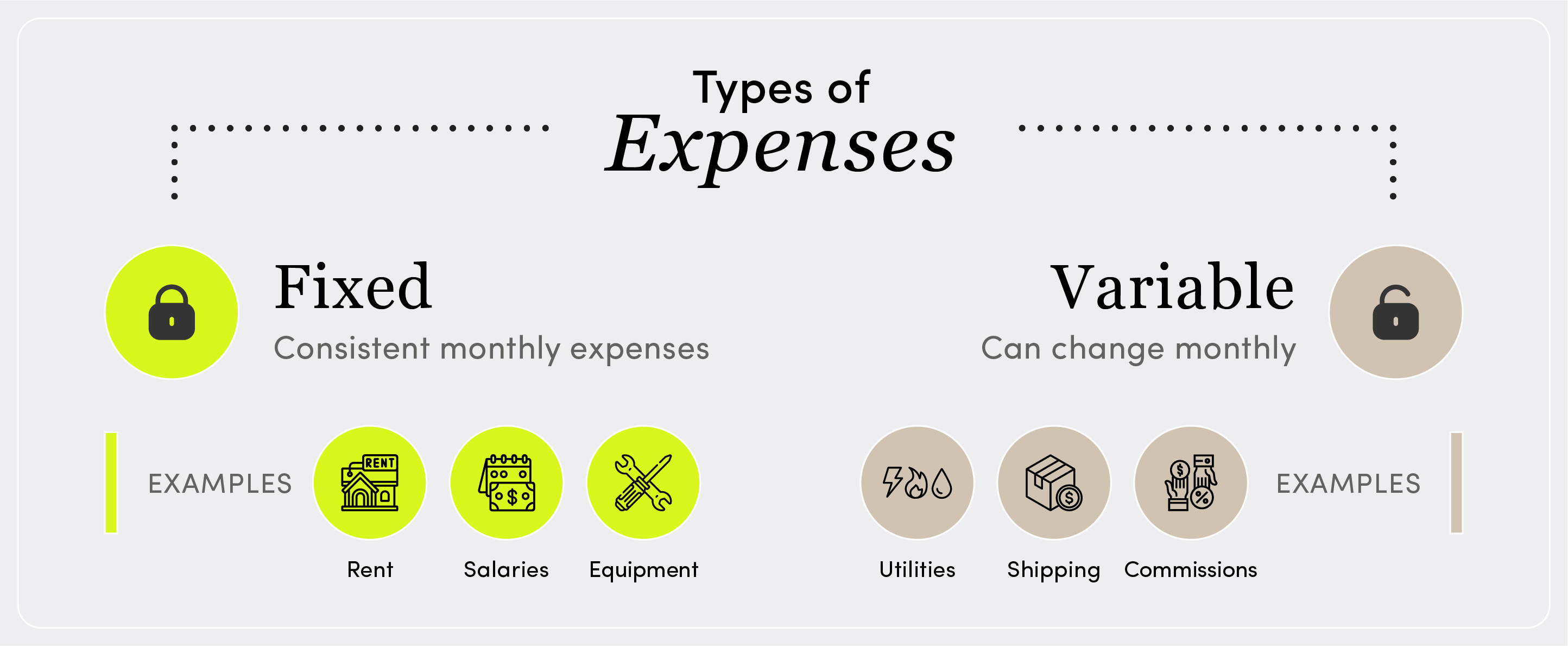

Every business has operating expenses — that is, the costs of running the business — and they usually take two forms: fixed expenses and variable expenses. Understanding the difference between the two gives you a clearer picture of not just where your money is going but also how each expense impacts your company. Below, get examples of each type and find out how your business can save on both.

Editor’s note: Need accounting software for your business? Fill out the below questionnaire to have our vendor partners contact you with free information.

Fixed vs. variable expenses

Fixed and variable expenses are part of your general ledger, which is how businesses keep track of their finances. A fixed expense means one that doesn’t change — it’s a set amount you pay on a recurring basis. A variable expense, on the other hand, may change due to a variety of factors, which means you can’t always predict exactly what it will cost. Both types of expenses can be direct or indirect costs.

These terms exist to differentiate between the types of costs businesses are expected to pay. As a business owner, you will have both types of expenses, so it’s important to distinguish between the two and create a budget accordingly. [Looking for help with expense tracking? Check out our recommendations for the best small business accounting software.]

Here are some key differences between fixed costs and variable costs.

- Fixed expenses remain static over a set period of time; variable expenses fluctuate depending on external factors.

- Fixed expenses are not impacted by production output. For example, you have to make the same office lease payment every month regardless of how much work you do in that office. Variable expenses, however, may increase or decrease based on your output because you’ll need to buy more raw goods and spend more on hourly labor in order to produce more output.

- Fixed expenses are often time-related, such as your monthly office lease payment. Variable expenses are often volume-related, such as the amount of time your hourly employees work each week.

Variable costs are typically part of the cost of goods sold (COGS), although fixed costs can be included in COGS as well. As prices for equipment and supplies rise, you’ll want to protect your business against inflation.

Variable expenses

A variable expense is a cost that changes depending on your production level. In other words, your sales volume directly impacts your variable expenses.

For example, let’s say you sell phone cases. Below is a chart explaining how those variable expenses would work. While the packaging cost per case remains the same, the total cost of packaging rises when production is higher.

Cases produced | Packaging costs | Total cost |

|---|---|---|

1 | $0.25 | $0.25 |

100 | $0.25 | $25 |

500 | $0.25 | $125 |

1,000 | $0.25 | $250 |

It’s critical to understand your total variable expenses from the start to see where you can potentially save money. Shaving the costs that go into selling each product makes a huge difference in your bottom line.

Here are some more examples of variable expenses:

- Utilities, like electricity and water

- Credit card and bank fees

- Hourly wages and direct labor

- Shipping costs

- Raw materials

- Sales commissions

Fixed expenses

Fixed costs are what most people refer to as overhead costs. These are the expenses you can’t reduce regardless of how much business you’re doing.

Indeed, your fixed costs may even increase over time. Rents go up, salaries increase and insurance premiums tend to rise. However, these costs are fixed in the sense that they don’t change based on your production volume. Whether you sell one phone case or a million, these costs remain the same.

Here are some common examples of fixed expenses:

- Rent

- Car payments

- Insurance

- Salaries

- Interest expenses

- Property taxes

- Leased equipment

- Loans

- Depreciation

Mixed (semi-variable) expenses

A third category of expenses is a mixture of fixed and variable. Let’s say you’re paying $100 for web hosting each month, but one month you exceed your bandwidth limit and are hit with an extra $20 fee. You’ll pay the fixed $100 no matter what, but the extra $20 is variable. Together, they make a mixed expense.

Another example would be if you have a salesperson working on commission. The base salary for this employee is fixed, but the commission they earn on each sale is variable, as the commission amount depends on the number of sales made. Thus, the employee’s total pay is a mixed expense.

You can set different bonus structures for employees depending on your business’s needs, which will affect your fixed and variable expenses. Learn more in our employee bonus guide.

How to save on variable and fixed costs

One way to increase your business’s profitability is to find ways to reduce operational costs. This often includes cutting back on large fixed costs, but it can also entail streamlining variable costs.

Saving on variable costs

- Search for ways to lower your utility bills. Use less electricity and water whenever possible, and opt for a cheaper internet or phone plan that still meets your company’s needs as a business. Monitor how much money you spend on utilities each month, which will reveal areas of waste and motivate your organization to be more energy efficient. [See our picks for the best business internet service providers, many of which offer bundle deals for cost savings.]

- Maintain the minimum balance in your bank accounts. Many banks require a minimum amount of money to be kept in specific accounts each month. If this is the case, make sure you always have this amount in your accounts to avoid unnecessary fees.

- Pay your credit card bills on time and in full. Late fees and interest charges can quickly become expensive — and they’re avoidable if you keep an organized payment schedule and budget for them.

- Streamline packaging and shipping. One way to do this is to adopt more eco-friendly packaging, which can save money. By optimizing your packaging and shipping processes, you can reduce the costs of each. Find ways to use less equipment, tailor the sizes of packages to the product, and consolidate shipments as much as possible.

Saving on fixed costs

- Renegotiate your rent or find a more affordable office space. If you want to lower your monthly rent, reach out to your landlord to negotiate a lower cost in exchange for a longer lease or a lease extension. If your current location is larger than you need or the cost is breaking the bank, look to downsize or move to a more affordable property.

- Find ways to reduce business insurance premiums. You may be able to do this by installing features in your office that eliminate or lower certain risks. For instance, if you pay for theft protection, you could install a security system instead of paying that ongoing insurance cost. You could also negotiate lower premiums if you have a good customer history with your insurance company. [Read related article: Ways to Save Money on Business Insurance]

- Lower your monthly lease or loan payments. It doesn’t hurt to ask for lower monthly payments on these agreements. Leasing companies and banks are often willing to extend your payments over a longer period of time to decrease the amount you must pay each month. While this might increase the interest rate, it can lower your costs until you’re in a more financially comfortable place.

- Only have a few managerial positions. Rather than hiring many managers and paying all of them a high salary, consider retaining only the best and compensating them well. You may be able to do this by merging similar departments under one manager.

Check out more ways to drastically cut business costs, such as utilizing co-working spaces.

The importance of understanding fixed and variable expenses

Don’t leave the understanding of fixed and variable expenses to your accountants. Getting a handle on business expenses is vital for any company that is serious about its future. It allows you to develop long-term financial plans that account for variables and hypothetical situations.

Sometimes you may have to decide between paying fixed or variable costs. There are benefits and risks associated with each. For example, if you’re an online retailer, you might choose to outsource each sale to a third party so you don’t need to handle shipping. It could work in your favor to pay the third party with variable expenses — meaning they’ll get a cut of each sale — so you don’t need to pay them if you don’t sell anything.

However, there could come a time when your sales are so high that these variable costs total a significant amount of money. At that point, you’ll need to consider whether it would save you money to invest in the fixed expense of hiring staff to handle shipping in-house.

The need to make decisions like these is why it pays to keep an eye on your fixed and variable expenses, because it might lead to fruitful negotiations and better profit margins. You should continuously review your balance sheets, income statements and other business financial statements to make any necessary adjustments. Understanding how these costs work will help you figure out what’s best for your company at all times.

Mike Berner and Sarah Landrum contributed to this article.