MENU

Starting a Business

- Best Small Business Loans

- Best Business Internet Service

- Best Online Payroll Service

- Best Business Phone Systems

Our Top Picks

- OnPay Payroll Review

- ADP Payroll Review

- Ooma Office Review

- RingCentral Review

Our In-Depth Reviews

Finance

- Best Accounting Software

- Best Merchant Services Providers

- Best Credit Card Processors

- Best Mobile Credit Card Processors

Our Top Picks

- Clover Review

- Merchant One Review

- QuickBooks Online Review

- Xero Accounting Review

Our In-Depth Reviews

- Accounting

- Finances

- Financial Solutions

- Funding

Explore More

Human Resources

- Best Human Resources Outsourcing Services

- Best Time and Attendance Software

- Best PEO Services

- Best Business Employee Retirement Plans

Our Top Picks

- Bambee Review

- Rippling HR Software Review

- TriNet Review

- Gusto Payroll Review

Our In-Depth Reviews

- Employees

- HR Solutions

- Hiring

- Managing

Explore More

Marketing and Sales

- Best Text Message Marketing Services

- Best CRM Software

- Best Email Marketing Services

- Best Website Builders

Our Top Picks

- Textedly Review

- Salesforce Review

- EZ Texting Review

- Textline Review

Our In-Depth Reviews

Technology

- Best GPS Fleet Management Software

- Best POS Systems

- Best Employee Monitoring Software

- Best Document Management Software

Our Top Picks

- Verizon Connect Fleet GPS Review

- Zoom Review

- Samsara Review

- Zoho CRM Review

Our In-Depth Reviews

Business Basics

- 4 Simple Steps to Valuing Your Small Business

- How to Write a Business Growth Plan

- 12 Business Skills You Need to Master

- How to Start a One-Person Business

Our Top Picks

Biz2Credit Review and Rates

Table of Contents

Biz2Credit offers flexible small business loans with repayment terms ranging from 12 to 36 months, low interest rates and transparent pricing. Biz2Credit’s lending platform can provide financing from $25,000 to $6 million.

- Biz2Credit’s starting rates for term loans are somewhat lower than similar providers’, which means you could pay lower total interest.

- The company connects you to funding sources that match your business’s needs.

- Biz2Credit’s minimum sales requirement of $250,000 excludes many small businesses.

- The company’s loan terms are shorter than alternatives, so monthly payments could be higher.

Biz2Credit is a marketplace lender that offers small business owners a variety of financing options. You can get access to term loans of up to $500,000, working capital financing of up to $2 million and commercial real estate funding of up to $6 million. With an easy application process and great customer service, Biz2Credit quickly matches you to funding sources based on your needs, making this company our choice for the best marketplace lender.

Biz2Credit Editor's Rating:

8.8 / 10

- Collateral

- 8.8/10

- Fast funding

- 8/10

- Loan variety

- 9/10

- Easy approval

- 8.5/10

- Customer service

- 9.5/10

Why We Chose Biz2Credit as the Best Marketplace Lender

Biz2Credit is a small business lending platform that works by matching you to funding sources based on your business’s profile. We like that Biz2Credit connects customers to financial products that fit their individual needs rather than trying to shoehorn them into a one-size-fits-all solution. Additionally, Biz2Credit offers a quick and easy application process, along with good starting rates and transparency around pricing and terms. For these reasons, we found Biz2Credit to be the best business loan and financing option for businesses seeking a marketplace lender.

business.com’s guide to alternative lending breaks down the different types of alternative lenders, including marketplace lenders such as Biz2Credit.

Loan Types and Rates

Biz2Credit can match you with several financing products, each with its own rates, terms and loan sizes. These include term loans, working capital loans, ERTC loans and commercial real estate loans.

Term Loans

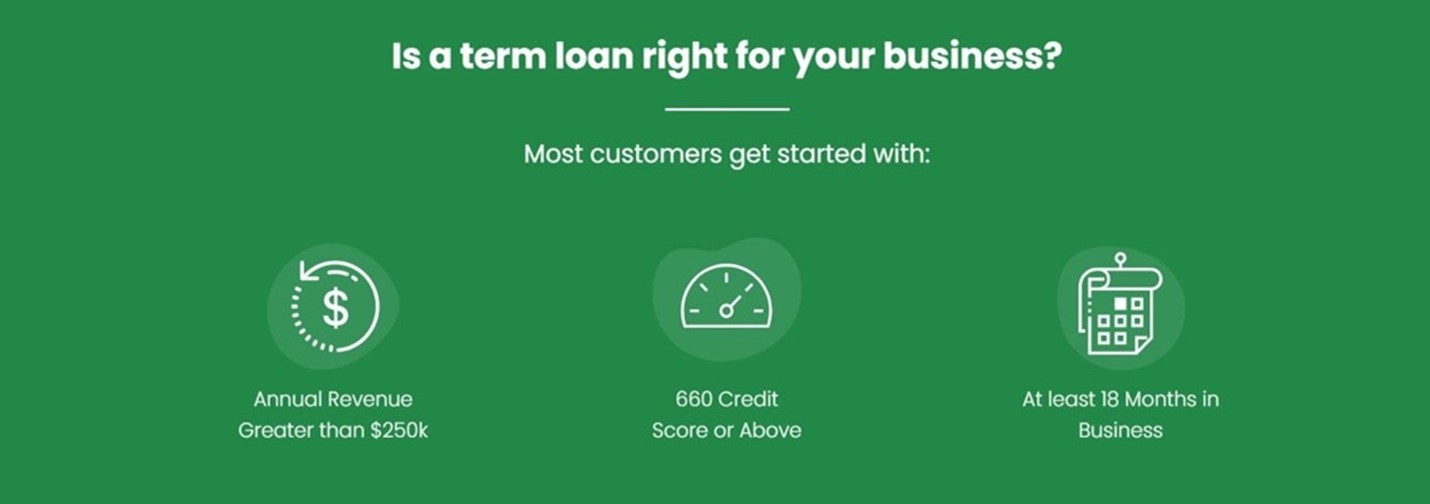

Term loans for small businesses are a popular option for business owners who are looking to grow their enterprises. These loans have simple interest and payments that remain fixed over a specified time period. This makes term loans a cheap source of funding and an alternative to lines of credit. Biz2Credit is transparent about its rates for different term loans, which start at 7.99%. Interest rates vary based on your credit score and other factors. To be eligible for a term loan, you must generate at least $250,000 in annual revenue, maintain a credit score of 660 or higher and show that you have been in operation for at least 18 months.

Biz2Credit’s website clearly states the company’s minimum requirements for term loan approval in this website screenshot. Source: Biz2Credit

Biz2Credit charges a $250 to $400 underwriting fee if you get funded. Bank financing also may entail a closing fee. Though these fees are probably small compared with monthly payments, some other providers, such as Noble Funding, have no (or lower) fees. On the other hand, there are no application fees or hidden charges. Repayment is weekly or biweekly, which may help keep payments more manageable.

Borrowers who link their business bank account with Biz2Credit get a discount on their loan.

Biz2Credit term loans range from $25,000 to $250,000 and have repayment terms of 12 to 36 months. Your account information stays with Biz2Credit, making it easy to get more funding as you grow. Because Biz2Credit is a marketplace lender, you have the option to shop your loan to a network of lenders, which isn’t something you can do with all small business funding providers.

Working Capital Loans

Working capital loans can be used for various short-term obligations and operations, including purchasing inventory, hiring employees, buying equipment and covering one-time expenses. With Biz2Credit’s working capital loans, business borrowers can access as much as $2 million in funding. Payment terms come from your business receipts, and payments can be daily, weekly or biweekly. Biz2Credit can approve a working capital loan application in one day and fund the loan within 72 hours. To qualify for the lender’s working capital loan, you need an annual revenue of at least $250,000, a credit score of 575 or higher and at least six months of operations behind you.

ERTC Loans

As a part of the CARES Act, Congress created a special employee retention tax credit (ERTC) for employers that kept workers on their payrolls during the COVID-19 pandemic. As a business owner, you can potentially save thousands of dollars by claiming your ERTC. However, many people have faced long wait times for receiving that money from the IRS. Biz2Credit offers an ERTC loan of up to $500,000 as an advance payment on those funds. Borrowers must have a pending credit of $100,000 or more, a credit score of at least 600 and business operations going back to February 2020. We like that, for the first 12 months, Biz2Credit merely requires interest-only payments, with the principal due when you receive your full IRS credit.

You have until April 1, 2025, to claim your 2021 ERTC.

Commercial Real Estate Loans

Commercial real estate (CRE) loans allow you to borrow money using your business’s property as collateral. Generally, these loans are made for the purpose of acquiring or developing commercial real estate. Through Biz2Credit’s commercial real estate program, small business owners can borrow anywhere from $250,000 to $6 million. The interest rates on these loans start at 10%, and business owners can qualify in 48 hours. Terms on the loans range from 12 to 36 months. To qualify for a CRE loan from Biz2Credit, you need to have been in business for at least 18 months and already own commercial property. Additionally, you must have an annual revenue greater than $250,000 and a credit score of at least 660.

Biz2Credit is transparent about its commercial real estate loan requirements shown in this website screenshot. Source: Biz2Credit

Terms

As an alternative lender, Biz2Credit can provide business owners more flexibility and support at different growth stages. With terms ranging from 12 to 36 months and a slightly lower starting rate, total interest paid on Biz2Credit loans may be lower than those of alternative providers with longer-duration loans. [Learn how to calculate loan payments.]

Collateral

Biz2Credit business term loans are unsecured, which means you don’t need to put up collateral for the loan. However, the company does require a personal guarantee, which means you’re liable if your business doesn’t pay back the loan. Other products, such as CRE loans, are backed by your business’s real estate holdings.

You’ll pay less in interest with a short-duration loan, but the monthly payments will be higher than for a longer-term loan with the same interest rate.

Special Documentation

Biz2Credit doesn’t specify which documents you need to apply for a term loan, but it’s a good idea to have your financial information — including business bank statements, tax information, proof of business ownership and a government-issued ID — at the ready to speed along the process. If you’re already using highly rated accounting software to keep track of your company’s finances, getting some of these details together shouldn’t be too challenging.

Application Process

We appreciate that Biz2Credit makes applying for a loan simple and straightforward, with clearly defined steps posted on the company’s website. You can become prequalified within minutes by answering three questions on how much funding your business needs, the general purpose of the funds and how long you need the money. The actual application is a short questionnaire that you can easily complete by connecting your business’s bank account. Biz2Credit says this process takes about four minutes. You’ll then receive your funding options within 24 hours, and from there, you can receive the funds in as little as two days. If necessary, you can connect to one of the company’s funding specialists to walk you through your options.

Biz2Credit’s prequalification form, shown in this screenshot, includes just a few basic questions. Source: Biz2Credit

Customer Support

Although Biz2Credit’s online platform can match you with a funding source automatically, many customers choose to speak with a funding specialist. Biz2Credit’s representatives are available by phone Monday to Friday from 8 a.m. to 7 p.m. ET. The company’s website also has a knowledge center with a library of research reports, e-books, guides and links to Biz2Credit’s YouTube channel.

During our investigation, we noticed that many customers praised Biz2Credit’s support staff in user reviews, where the company received high marks. Biz2Credit maintains a score of 4.6 out of 5 on user-generated review site Trustpilot. Out of over 14,000 reviews, 83 percent of customers left a five-star rating, which is impressive compared to many alternative lenders.

We also found Biz2Credit’s free online loan calculators to be particularly useful. Business owners can use these simple tools to compute monthly payments, total repayment and interest costs.

Biz2Credit features free financial calculators on its website, including the term loan calculator shown in this screenshot. Source: Biz2Credit

Limitations

Biz2Credit is the top marketplace lender for small business owners, but there are some potential drawbacks to consider. One is that you need more than $250,000 in annual sales to qualify for assistance, which may shut out smaller businesses and many sole proprietors. Biz2Credit’s term loan also has a credit score requirement of 660. This affords eligible applicants a lower interest rate, but it also shuts out business owners with lower credit scores. Startups will also have trouble getting funding from Biz2Credit, because the term loan requires a minimum of 18 months in business. If your enterprise doesn’t meet the company’s requirements, it might be worth exploring how to grow small business capital without a loan. However, we also recommend taking a look at our review of Fora Financial, which has much lower qualifications across the board.

In addition, Biz2Credit’s loan terms are for a maximum of 36 months, which means that monthly payments will be higher than they would be for longer-term loans (although total financing costs will be lower, all other things being equal). Business owners who prioritize lower monthly payments should check out our Noble Funding review instead.

Methodology

In looking for the best business financing options on the market, we investigated loan providers and their platforms based on factors such as credit requirements, loan types, minimum sales requirements, required minimum time in business, customer service availability and the speed of funding. We also assessed financial factors, including starting interest rates, loan terms and the loan sizes offered. To identify the top marketplace lender, we looked at each company’s loan options and how easily each platform connected small business owners to the appropriate source of capital.

FAQs

On Biz2Credit, you can get term loans, working capital loans, CRE loans and ERTC loans. Biz2Credit’s specialists can also help you obtain traditional bank loans, lines of credit, Small Business Administration (SBA) loans and more.

No, Biz2Credit is not a direct lender. It is a company that connects businesses with banks and financial institutions in its network. However, Biz2Credit does operate lending subsidiaries in several states.

Yes, Biz2Credit can connect you with various SBA funding sources in its network.

Bottom Line

We recommend Biz2Credit for …

- Business owners who prioritize lower overall financing costs rather than low monthly payments.

- Business owners who want access to a variety of lenders through a marketplace approach.

We don’t recommend Biz2Credit for …

- Startups with little operational history or small businesses that don’t meet the minimum sales requirements.

- Businesses that prioritize a longer repayment term and lower monthly payments.