MENU

Starting a Business

- Best Small Business Loans

- Best Business Internet Service

- Best Online Payroll Service

- Best Business Phone Systems

Our Top Picks

- OnPay Payroll Review

- ADP Payroll Review

- Ooma Office Review

- RingCentral Review

Our In-Depth Reviews

Finance

- Best Accounting Software

- Best Merchant Services Providers

- Best Credit Card Processors

- Best Mobile Credit Card Processors

Our Top Picks

- Clover Review

- Merchant One Review

- QuickBooks Online Review

- Xero Accounting Review

Our In-Depth Reviews

- Accounting

- Finances

- Financial Solutions

- Funding

Explore More

Human Resources

- Best Human Resources Outsourcing Services

- Best Time and Attendance Software

- Best PEO Services

- Best Business Employee Retirement Plans

Our Top Picks

- Bambee Review

- Rippling HR Software Review

- TriNet Review

- Gusto Payroll Review

Our In-Depth Reviews

- Employees

- HR Solutions

- Hiring

- Managing

Explore More

Marketing and Sales

- Best Text Message Marketing Services

- Best CRM Software

- Best Email Marketing Services

- Best Website Builders

Our Top Picks

- Textedly Review

- Salesforce Review

- EZ Texting Review

- Textline Review

Our In-Depth Reviews

Technology

- Best GPS Fleet Management Software

- Best POS Systems

- Best Employee Monitoring Software

- Best Document Management Software

Our Top Picks

- Verizon Connect Fleet GPS Review

- Zoom Review

- Samsara Review

- Zoho CRM Review

Our In-Depth Reviews

Business Basics

- 4 Simple Steps to Valuing Your Small Business

- How to Write a Business Growth Plan

- 12 Business Skills You Need to Master

- How to Start a One-Person Business

Our Top Picks

The Game of Pricing: How the Number 9 Affects Purchase Behavior

Table of Contents

Almost all marketing revolves around trying to get into customers’ heads. What do they want? How much are they willing to pay for it? Which words or images will increase their purchase intent? How can we create a sense of urgency?

While we like to think of ourselves as rational beings, humans make decisions frequently, including purchase decisions, based on emotions, assumptions, shortcuts and logical fallacies. When businesses understand what lies behind their target market’s thought processes, they can use this information to increase sales and maximize profits.

Charm pricing is a pricing strategy based on the psychology of choice. We’ll explain why it’s highly effective and share best practices for setting a pricing strategy.

The concept of charm prices

We see countless “charm” prices (prices that end in the number 9) daily.

There’s no real consensus about how this came to be while a few different apocryphal stories exist. Still, there is little disagreement with the idea that charm prices convey value and motivate customers, ultimately, increasing sales.

Charm prices work because of the “left digit effect,” which proposes that people place more importance on the leftmost digit in a price. Therefore, $79.99 seems closer to $70 than $80.

In one famous study, three different versions of the same mail-order catalog were printed with each version showed the same shirt at a different price. The shirt sold better at $39 than at $44. This result is not surprising because it illustrates the law of demand: As the price goes down, demand goes up. However, the shirt also sold better at $39 than at $34. This illustrates that charm prices have an impactful effect and can undermine even our most basic expectations about the effect of price on demand.

Between 40 and 95 percent of retail prices end in 9. A left-digit bias study shows consumers assume these prices are 15 to 20 cents lower. Prices ending in 9 are, on average, 18 percent higher than prices not ending in 9.

When charm prices don’t work

Many people say that they don’t like nonrounded charm prices and research supports this. When pumping gas, nobody tries to stop at $29.99. They try to get to a nice, round number like $30. But what people like often has minimal impact on what influences them and sellers ignore the power of charm pricing at their peril.

In 2012, ousted CEO Ron Johnson tried to do away with charm pricing as part of an effort to revamp JCPenney. Although getting rid of charm pricing was only part of many more extensive changes to the business’s pricing strategy, the changes were not well-received and the damage was significant.

Dynamic pricing is another pricing model. With dynamic pricing, prices adjust continuously in response to real-time supply and demand.

Charm pricing vs. prestige pricing

Charm pricing uses prices ending in the digit 9. Interestingly, studies have shown that ending prices in other odd numbers, such as 7 and 5, can work too. Since consumers associate prices ending with an odd number with a lower overall price than one ending in an even number,

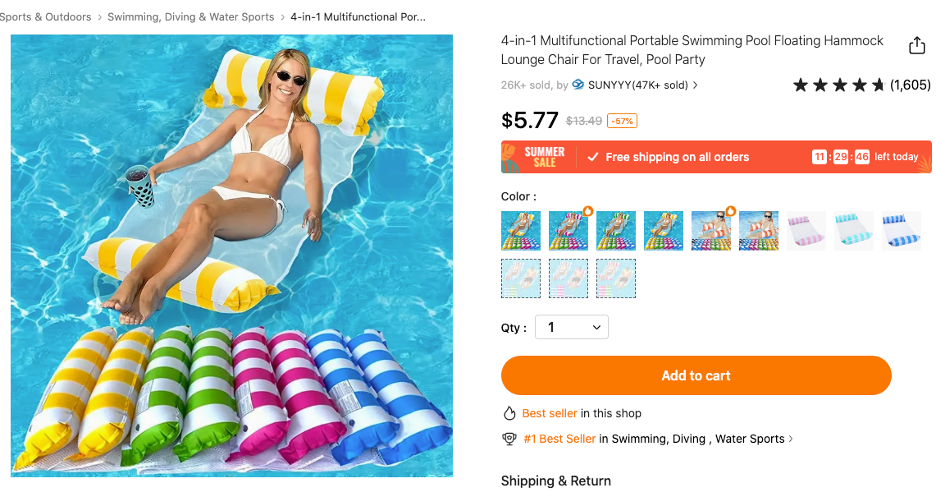

Charm pricing is used when targeting consumers looking for value

Source: Temu

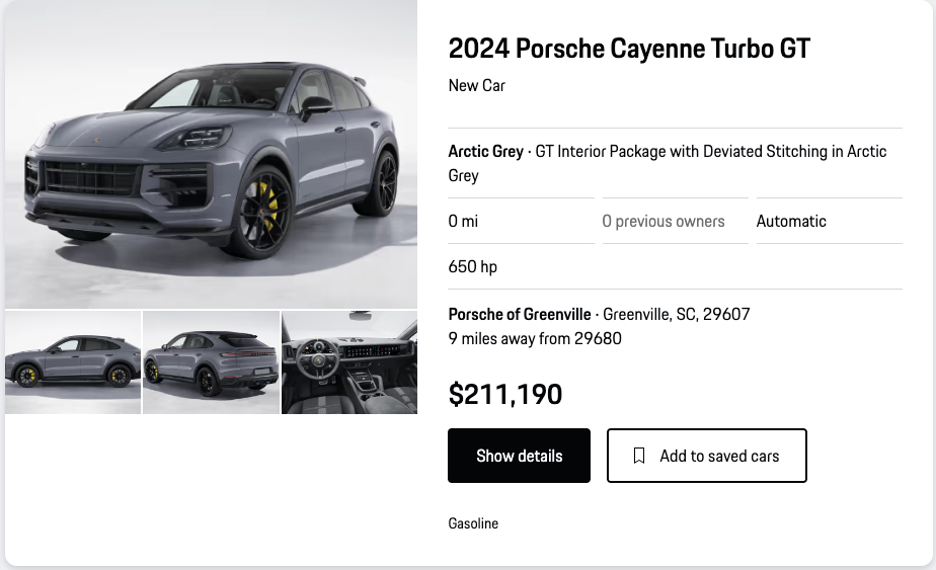

In contrast, prestige pricing seeks to avoid the taint of anything associated with bargain hunting. Luxury goods are often priced ending in even digits. Whole numbers convey that price is not a salient issue compared to other criteria like product quality and social status.

The previously mentioned left-digit bias study showed that raising the price of a product to $5.00 from $4.99 resulted in 4.5 percent fewer sales.

Source: Porsche

The perceived value when pricing

So, should all prices end in the number 9? Research has demonstrated that charm prices powerfully imply value. Customers are more likely to perceive the price as being lower and representing a discount. That being said, charm prices say something very different about quality.

Upscale retailers know this and use it to their advantage. If you look at the price tags from a high-end department store, you’ll see that they’re almost always rounded. These stores aren’t selling value – they’re selling quality and luxury. Rounded numbers convey quality and luxury and are used almost exclusively in settings where quality is of utmost importance.

But when these luxury items are marked down for sale, nonrounded and charm numbers come back into play. The high-end shirt that normally sells for $400 is marked down 50 percent and sold at $199.99. As soon as you put an item on sale, you are selling value over quality and luxury retailers are eager to tap the power of charm pricing.

If you need to raise your prices, using charm pricing can help mitigate the drop in demand.

The use case for rounded and nonrounded pricing

When is each pricing model most effective? Round numbers are more fluently processed and encourage reliance on feelings. Meanwhile, nonrounded numbers are not as easily processed, creating a reliance on cognition. This means you must understand consumer emotions when creating a pricing strategy. For example, if someone wants to buy a nice handbag as a reward for getting a bonus, round numbers are best. But if the decision is driven by cognition, such as a thought process of “I should buy this because it’s a good deal,” charm prices are better.

Consider the implications for a florist or caterer submitting quotes for a wedding. If they’re dealing with the couple and their family members, decisions will likely be emotional in nature and they should use rounded numbers when pricing. In contrast, if they’re quoting on a convention dinner or fundraising gala while dealing with an event planner, things are very different. This purchasing decision would likely be more intellectual in nature and they would be better off using nonrounded prices.

At the end of the day, pricing comes down to identifying your target customer.