MENU

Starting a Business

- Best Small Business Loans

- Best Business Internet Service

- Best Online Payroll Service

- Best Business Phone Systems

Our Top Picks

- OnPay Payroll Review

- ADP Payroll Review

- Ooma Office Review

- RingCentral Review

Our In-Depth Reviews

Finance

- Best Accounting Software

- Best Merchant Services Providers

- Best Credit Card Processors

- Best Mobile Credit Card Processors

Our Top Picks

- Clover Review

- Merchant One Review

- QuickBooks Online Review

- Xero Accounting Review

Our In-Depth Reviews

- Accounting

- Finances

- Financial Solutions

- Funding

Explore More

Human Resources

- Best Human Resources Outsourcing Services

- Best Time and Attendance Software

- Best PEO Services

- Best Business Employee Retirement Plans

Our Top Picks

- Bambee Review

- Rippling HR Software Review

- TriNet Review

- Gusto Payroll Review

Our In-Depth Reviews

- Employees

- HR Solutions

- Hiring

- Managing

Explore More

Marketing and Sales

- Best Text Message Marketing Services

- Best CRM Software

- Best Email Marketing Services

- Best Website Builders

Our Top Picks

- Textedly Review

- Salesforce Review

- EZ Texting Review

- Textline Review

Our In-Depth Reviews

Technology

- Best GPS Fleet Management Software

- Best POS Systems

- Best Employee Monitoring Software

- Best Document Management Software

Our Top Picks

- Verizon Connect Fleet GPS Review

- Zoom Review

- Samsara Review

- Zoho CRM Review

Our In-Depth Reviews

Business Basics

- 4 Simple Steps to Valuing Your Small Business

- How to Write a Business Growth Plan

- 12 Business Skills You Need to Master

- How to Start a One-Person Business

Our Top Picks

Table of Contents

Partnerships must use Schedule K-1 tax forms to distinguish the business’s income from their owners’ personal income. By doing so, your partnership is more likely to avoid the $54,171 in tax penalties the average partnership faces each year for improperly filing their taxes. Completing a Schedule K-1 form may seem difficult at first, but with the below primer, it doesn’t have to be.

What is a Schedule K-1 tax form?

A Schedule K-1 tax form is found within IRS Form 1065 — it is the form you’ll use to report your partnership’s net income for the tax year in question. Partners in a partnership or LLC will each receive a Schedule K-1 from the partnership.

Each partner should use a K-1 form to inform the IRS of their individual share of the company’s losses, credits and deductions.

Who has to file a K-1 tax form?

All partnerships must file K-1 tax forms for each partner as part of their tax returns. Additionally, the partners must include a K-1 tax form with their individual tax return whether they are a partner in a general partnership, limited partnership, limited liability partnership or an LLC taxed as a partnership. You must also file a Schedule K-1 if you’re a shareholder in an S corporation.

Partners must file Schedule K-1 forms because partnerships are taxed as pass-through entities. In this type of structure, a company’s profits and losses “pass through” the partnership to all of the partners without being taxed. Schedule K-1 quantifies this profit or loss. It also clarifies how much of your partnership’s loss or income you should include in your personal tax returns.

K-1 forms for business partnerships

Since the co-owners of a business partnership pay taxes on the company’s income and the business itself does not, the partnership must file several Schedule K-1 forms. This way, each partner’s share of taxable profits or losses is properly recorded for both the company and the individual owners.

Additionally, each partner must receive a copy of their Schedule K-1 for use in their personal tax returns. Although this arrangement may feel tedious or confusing, filing and distributing K-1s is easy. Here are a few examples to clarify the process.

Let’s say you’re a partner in a company that earns $50,000 of taxable income in a given year. If you and your one business partner each own 50 percent of the business, you should each receive a Schedule K-1 that declares $25,000 of income. For four equal partners, this amount drops to $12,500. For one partner who owns 40 percent and another who owns 60 percent, the former will receive a K-1 for $20,000 and the latter for $30,000.

The partnership as a whole must file Schedule K-1 forms for each partner. Additionally, each partner must receive a copy of their Schedule K-1 for their personal tax returns.

K-1 forms for LLCs

By default, your LLC is a partnership, but you can file IRS paperwork to register it as another type of federal business structure. Whether you need to complete a Schedule K-1 form for your LLC taxation depends on this structure. If your company is a C corporation or sole proprietorship, it does not need to file a Schedule K-1. In all other cases, K-1 forms are required.

If your company is a partnership, you’ll file a K-1 as described above. The process works somewhat differently for S corporations. Within your company’s annual Form 1120-S tax return, you should include K-1 forms for each shareholder. Each K-1 should state the shareholder’s profits, losses, credits and deductions. Each shareholder should also receive a copy of their K-1 for use with their personal tax returns.

K-1 forms for trust and estate beneficiaries

Occasionally, a living trust is a partner in a partnership. In this case, you should be aware of how K-1 forms work for trusts or estates.

If a trust or estate passes its tax burden to its beneficiaries, the trust or estate must include a Schedule K-1 in its IRS Form 1041 tax return and send a copy to the beneficiary. The beneficiary will then include this K-1 form with their individual tax returns. This K-1 will likely include more money recorded as distributions than ordinary income.

Where can you find a Schedule K-1 tax form?

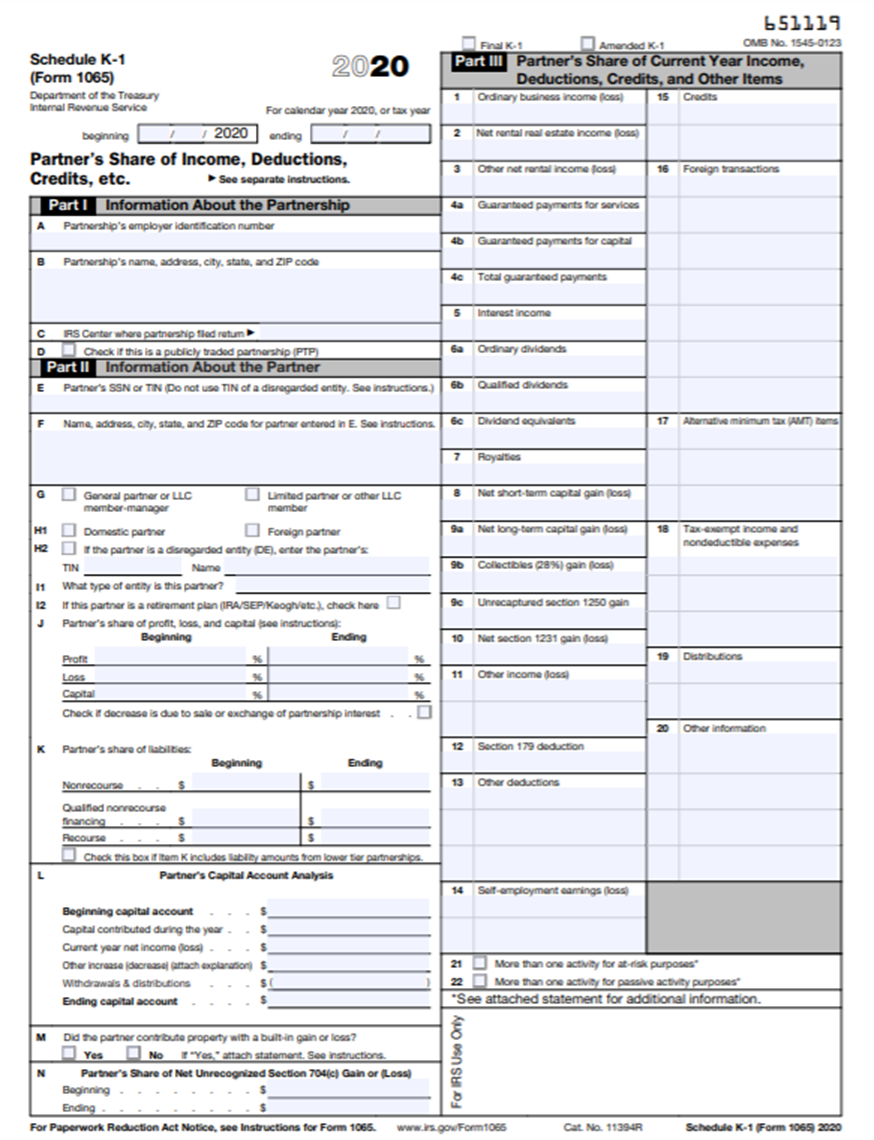

The IRS has Schedule K-1 forms on its website. You can download the K-1 form in fillable PDF format for either you or your accountant to use. The form looks like this:

Source: Internal Revenue Service

There are three different types of Schedule K-1s available on the IRS website. There is a version for partners, one for shareholders and another for beneficiaries of a trust.

How to fill out a K-1 form

To complete a K-1 form, take the following steps:

1. Indicate the tax year in question.

You should see boxes for adding the start and end dates of the tax year in the top left corner of your K-1 form. Fill these out before proceeding further.

2. Add your basic identifying information.

In Part I of the K-1 form, you should see spaces for adding your company’s employer identification number, name and address. Add this info here.

3. Indicate the IRS center where you filed your tax return.

You’ll need to add this information in Part I, Box C. To find this info, look at your previous tax return or ask your accountant.

4. Add the partner’s identifying information.

Each K-1 form that your partnership completes is for one partner. Make sure you don’t file the wrong information for the wrong partner by adding the appropriate partner’s identifying number (likely a Social Security number), name and address at the top of Part II.

5. Indicate the type of partner.

Use Part II, Box G to indicate whether the partner is a general or limited partner. In Box H, check either domestic or foreign partner as appropriate. Then, in box I1, write “individual” to indicate that the partner is a person, not an entity.

6. List the partner’s profit, loss and capital shares.

If the partner in question owns 50 percent of your business, indicate this percentage in all six fields in Part II, Box J. The numbers in the “Ending” column will only differ if the partner’s share of the ownership changed at some point during the tax year.

7. Complete the liability share and capital account fields.

Assuming your partnership uses accrual-based accounting, you’ll need to complete Part II, Boxes K and L to reflect the partner’s share of the values listed therein. This part can get tricky, but an accountant can walk you through it based on your books.

8. Indicate any property contributions with built-in gain or loss.

Occasionally, assets that a partner contributes to a company come with built-in gains or losses. Check the appropriate item in Part I, Box M to indicate any such gains or losses.

9. Add the partner’s ordinary business income.

In Part III, Box 1, you must add the partner’s direct income from the business. If the partnership generated $75,000 in income during the tax year and the partner owns 50 percent of the business, their income for Box 1 would be $75,000 x 0.5 = $37,500.

10. Add additional income line items.

Often, you will also need to add dollar amounts for the following line items in Part III:

- Guaranteed payments (Boxes 4a, 4b and 4c)

- Interest income (Box 5)

- Section 179 equipment deductions (Box 12)

- Other deductions (Box 13)

- Self-employment earnings (Box 14)

- Distributions (Box 19)

Your accountant may find most of these numbers more readily than you can, but calculating your self-employment earnings is usually simple. In general, it’s the same as your ordinary business income, since the IRS levies self-employment taxes on companies with pass-through taxation structures.

11. File your K-1 form and give all partners copies.

Once you’ve followed the above steps, your K-1 form is ready. Add it to your IRS Form 1065 and send each partner their copy. Instructions for individual use are available on page two of the K-1 form.

Despite the above guidance, you’re likely to still have questions, as Part III of the K-1 form has over a dozen fields where you can enter profits or losses. If you have questions, ask your accountant or bookkeeper. If you don’t yet have one, decide whether an accountant or bookkeeper is better for you, then hire one. When you have a financial expert in your corner, keeping your partnership tax compliant should be far less of a hassle.

What happens when you don’t file a K-1 correctly (or at all)

Penalty for late filing

K-1 forms are due on the fifteenth day of the third month after the company’s fiscal year ends. For companies that follow a calendar year, that is March 15. If your business files an extension, it is an additional six months. For example, if your company’s fiscal year follows the calendar year and you file an extension, the deadline is September 15.

If you file the Schedule K-1 or your corporate tax return with K-1s late, the penalty is $200 per Schedule K-1 for each month or part of a month that it is late. If you have a lot of partners or are very late, this can add up. However, the IRS does cap this penalty at twelve months or $2,400 per Schedule K-1. If you are more than 12 months late, your business will be subject to collection activity and penalties from the IRS, including possibly having your assets seized.

Penalty for not furnishing K-1s to partners in a timely manner

The IRS draws a distinction between being negligent and being intentional when you fail to give each of your partners their K-1s so that they can have them to file. If you forget to do it, the penalty is $260 for each K-1, up to a maximum of $3,218,500. If they decide that you purposely did not give K-1s to partners, the penalty is $530 per K-1 with no maximum.

Mitigating IRS penalties for K-1s

The best way to avoid penalties is to file your K-1 forms and distribute them to your partners on time. However, if your business is assessed one of these heavy penalties in regard to K-1 forms, you have the option of contacting the IRS on your own or through a tax attorney to get the penalty lowered or waived. The IRS does make some exceptions when they decide that the failure was due to “reasonable cause.” Some examples of this are listed below:

- This is the first time your business has made this mistake, and previously you have always filed and distributed K-1s on time.

- This is the first time your business was required to file a K-1.

- The relevant business records were unavailable due to a “supervening event,” such as a fire or the death or serious illness of the person responsible for filing.

- The company gave its records to an accountant to file on time but the accountant failed to file the form when it was due and had a reasonable reason why this happened.