MENU

Starting a Business

- Best Small Business Loans

- Best Business Internet Service

- Best Online Payroll Service

- Best Business Phone Systems

Our Top Picks

- OnPay Payroll Review

- ADP Payroll Review

- Ooma Office Review

- RingCentral Review

Our In-Depth Reviews

Finance

- Best Accounting Software

- Best Merchant Services Providers

- Best Credit Card Processors

- Best Mobile Credit Card Processors

Our Top Picks

- Clover Review

- Merchant One Review

- QuickBooks Online Review

- Xero Accounting Review

Our In-Depth Reviews

- Accounting

- Finances

- Financial Solutions

- Funding

Explore More

Human Resources

- Best Human Resources Outsourcing Services

- Best Time and Attendance Software

- Best PEO Services

- Best Business Employee Retirement Plans

Our Top Picks

- Bambee Review

- Rippling HR Software Review

- TriNet Review

- Gusto Payroll Review

Our In-Depth Reviews

- Employees

- HR Solutions

- Hiring

- Managing

Explore More

Marketing and Sales

- Best Text Message Marketing Services

- Best CRM Software

- Best Email Marketing Services

- Best Website Builders

Our Top Picks

- Textedly Review

- Salesforce Review

- EZ Texting Review

- Textline Review

Our In-Depth Reviews

Technology

- Best GPS Fleet Management Software

- Best POS Systems

- Best Employee Monitoring Software

- Best Document Management Software

Our Top Picks

- Verizon Connect Fleet GPS Review

- Zoom Review

- Samsara Review

- Zoho CRM Review

Our In-Depth Reviews

Business Basics

- 4 Simple Steps to Valuing Your Small Business

- How to Write a Business Growth Plan

- 12 Business Skills You Need to Master

- How to Start a One-Person Business

Our Top Picks

Table of Contents

The Paycheck Protection Program (PPP) provided much-needed relief to businesses of all sizes in 2020 and 2021. First-draw PPP loans were available for up to $10 million, with second-draw loans up to $2 million. Best of all, they were 100 percent forgivable for qualifying borrowers.

PPP loans ended on May 31, 2021, and out of the 11.5 million loans issued, 10.5 million were forgiven. Here’s what you need to know about PPP loan forgiveness and how the application process works.

What is PPP loan forgiveness?

The Paycheck Protection Program was created at the height of the pandemic to help small businesses survive. Congress empowered the Small Business Administration (SBA) to issue hundreds of billions of dollars in low-interest small business loans.

Since then, the SBA reports that nearly $800 billion has been released to 8.5 million small businesses. The PPP loans are forgivable as long as the borrower uses the money for qualified expenses, including keeping staff on their payroll. It also can be used for certain operating expenses and other business costs associated with the pandemic.

Borrowers are welcome to seek loan forgiveness as soon as the proceeds have been used. They can apply anytime up to the loan’s maturity date, which is 10 months after the loan was issued. For example, businesses that took out PPP loans in January must start repaying in November if they haven’t been approved for loan forgiveness.

“You have up until the loan matures if you are requesting forgiveness, but there is no incentive to wait,” said Alan Haut, the U.S. Small Business Administration’s district director for North Dakota. “You’ll have to start making payments if you apply after the deferment period.”

The SBA is no longer awarding PPP loans. However, if your business needs financing, you have many other types of loans to choose from.

How do you apply for PPP loan forgiveness?

Depending on how much you borrowed, applying for PPP loan forgiveness can be a matter of minutes or may require more effort. Either way, here are the steps to follow:

Step 1: Contact your lender.

The first step in getting PPP loan forgiveness is to contact your lender directly. The lender has a responsibility to help borrowers get their loan forgiven. The SBA streamlined the process by launching the PPP Direct Forgiveness Portal, which allows borrowers to automatically submit their forgiveness application to the lender.

There’s a big caveat with this new tool. The lender has to sign up for the SBA’s portal, which not all lenders have done. The SBA provided a list of participating lenders you can check to see if your lender is included.

“You have to contact your lender and make sure they opted in,” Haut said. “Many lenders have an online process of their own that is quick and easy. Starting with the lender is the best option.”

If your lender is part of the Direct Forgiveness Portal and does not have an online portal of its own, use the SBA tool.

If your business needs financing, check out our recommendations for the best business loans.

Step 2: Determine if you are eligible for loan forgiveness.

To get your PPP loan forgiven, you must meet specific requirements. The size of the loan will determine how much proof you need to provide. The eligibility requirements are as follows:

- At least 60 percent of the loan total was used to cover payroll costs and expenses.

- The remainder of the loan was spent on mortgage interest or rent, utility expenses, operating costs, property damage caused by the pandemic, supplies and personal protective equipment (PPE).

- Employers attempted to maintain employment levels and pay that were in line with levels prior to the pandemic.

If you can check off these boxes, you can move on to the next step.

In the first iteration of the PPP loan program, all Economic Injury Disaster Loans (EIDLs) small business owners received were deducted from the amount of PPP loan that could be forgiven. That is no longer the case. This means that even if you received other aid from the SBA, you can still get your PPP loan fully forgiven.

Step 3: Determine which application is right for you.

To receive forgiveness for your PPP loan, complete an SBA Form 3508. There are three versions of the application, based on the size of the loan and the number of employees on payroll.

Each application requires basic business information, including name and address, tax ID number, and contact information. You’ll need to indicate whether this is your First Draw or Second Draw PPP loan and input the loan amount and terms.

The main difference between the forms is the number of calculations you are required to perform.

SBA Form 3508EZ

Use Form 3508EZ if your business has no employees and can meet one of the following criteria:

- You are self-employed with no employees.

- You didn’t reduce employee salaries by more than 25 percent.

- Employees’ hours stayed the same.

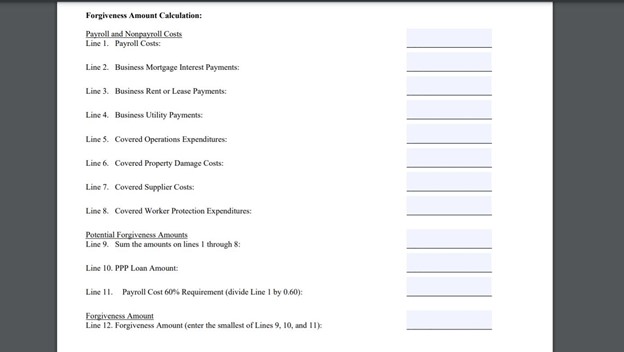

This three-page application includes the calculation form, signature form and an optional demographic information form. It requires you to list how the PPP loan was spent and to calculate your loan forgiveness amount.

SBA Form 3508EZ requires you to calculate your PPP expenses. Source: U.S. Small Business Administration

Hold on to your documentation showing how you used your small business loan funds for six years after the loan is forgiven. That is a requirement in case there is a review down the road.

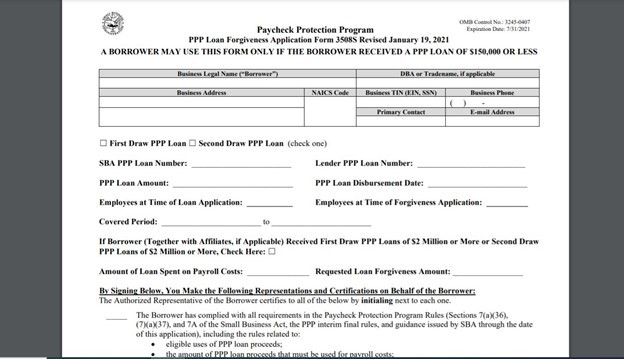

SBA Form 3508S

Form 3508S is the most straightforward PPP loan forgiveness application to complete. It is only for borrowers with loans of $150,000 or less. This two-page application requires no documentation and few calculations. When you use Form 3508S, no documentation is needed if it is your first PPP loan. For Second Draw PPP loans, borrowers have to prove that their revenue fell at least 25 percent.

Form 3508S requires no documentation. The loan amount can’t exceed $150,000. Source: U.S. Small Business Administration

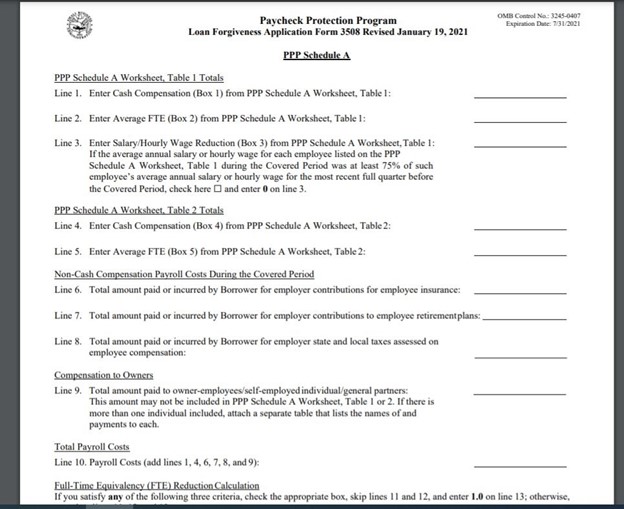

SBA Form 3508

Form 3508 is the most complex of the three applications. It is for small business borrowers who aren’t eligible to complete a 3508EZ or 3508S form. The forgiveness application is five pages long and requires the most calculations. It includes a calculation page, signature form, Schedule A, Schedule A worksheet and the optional demographic information form.

The Schedule A page of Form 3508 requires extensive information. This is just a snapshot of some of the information required. Source: U.S. Small Business Administration

Step 4: Don’t wait too long to apply.

If you use the money from your PPP loan for its intended functions, you are guaranteed to receive loan forgiveness from your lender. But if you wait too long to apply, you could be forced to begin repaying the loan.

“Small business owners need to know they only have 10 months to procrastinate,” said Brock Blake, CEO of online loan marketplace Lendio. “Once it’s 10 months from when you got the loan, it is the day of reckoning. You have to start making payments after that.”

PPP loan forgiveness FAQ

First- and second-draw PPP loans are available for forgiveness if they meet the following criteria:

- You spent the funds during the eight- to 24-week covered period.

- All employee and compensation levels were maintained.

- At least 60 percent of the funds were spent on payroll costs.

Eligible payroll costs include salaries, wages and commissions, capped at $100,000 annually per employee. It also includes employee benefits and state and local taxes assessed based on employee compensation. [See related article: Best Online Payroll Services]

Yes. If less than 60 percent of the funds were used on payroll costs, partial loan forgiveness is still available. Once borrowers received notice that their loans had been partially forgiven, they also had up to 30 days to appeal the decision. This was largely due to the confusion surrounding loan forgiveness and what was considered an eligible expense.

Borrowers who didn’t receive PPP loan forgiveness were responsible for repaying the loan. The loan terms included a 1 percent interest rate and five-year repayment terms. Borrowers could defer loan payments for up to six months, but interest began accumulating immediately.

Jamie Johnson contributed to this article. Source interviews were conducted for a previous version of this article.