MENU

Starting a Business

- Best Small Business Loans

- Best Business Internet Service

- Best Online Payroll Service

- Best Business Phone Systems

Our Top Picks

- OnPay Payroll Review

- ADP Payroll Review

- Ooma Office Review

- RingCentral Review

Our In-Depth Reviews

Finance

- Best Accounting Software

- Best Merchant Services Providers

- Best Credit Card Processors

- Best Mobile Credit Card Processors

Our Top Picks

- Clover Review

- Merchant One Review

- QuickBooks Online Review

- Xero Accounting Review

Our In-Depth Reviews

- Accounting

- Finances

- Financial Solutions

- Funding

Explore More

Human Resources

- Best Human Resources Outsourcing Services

- Best Time and Attendance Software

- Best PEO Services

- Best Business Employee Retirement Plans

Our Top Picks

- Bambee Review

- Rippling HR Software Review

- TriNet Review

- Gusto Payroll Review

Our In-Depth Reviews

- Employees

- HR Solutions

- Hiring

- Managing

Explore More

Marketing and Sales

- Best Text Message Marketing Services

- Best CRM Software

- Best Email Marketing Services

- Best Website Builders

Our Top Picks

- Textedly Review

- Salesforce Review

- EZ Texting Review

- Textline Review

Our In-Depth Reviews

Technology

- Best GPS Fleet Management Software

- Best POS Systems

- Best Employee Monitoring Software

- Best Document Management Software

Our Top Picks

- Verizon Connect Fleet GPS Review

- Zoom Review

- Samsara Review

- Zoho CRM Review

Our In-Depth Reviews

Business Basics

- 4 Simple Steps to Valuing Your Small Business

- How to Write a Business Growth Plan

- 12 Business Skills You Need to Master

- How to Start a One-Person Business

Our Top Picks

Stripe vs Stax Comparison

Table of Contents

As more consumers switch over entirely to credit cards and mobile payments, small businesses have been forced to adapt to an increasingly cashless world. The ability to accept credit cards puts your business in a position to capture more sales. To do that, you will first need one of the best credit card processors. Two popular options for small businesses are Stripe and Stax.

To help you decide between these two heavyweights, we performed a deep dive into each of their credit card processing services. We paid particular attention to several key areas, including pricing, payment methods, hardware options, integrations and customer service. Here is how Stripe and Stax compare in each of these categories.

Stripe vs. Stax highlights

Stripe and Stax both serve as payment processors that allow businesses to accept a wide range of payment methods. These include credit and debit cards, along with digital wallets, such as Apple Pay. Ensuring Payment Card Industry (PCI) compliance is a fundamental requirement for any merchant and both Stripe and Stax ensure that you follow credit card processing rules and laws. Nevertheless, they each possess unique features and capabilities, making them suitable for different scenarios.

Criteria | Stripe | Stax |

|---|---|---|

Best for | E-commerce businesses and web developers | High-volume businesses |

Pricing | 2.9% plus 30 cents (online); 2.7% plus 5 cents (in-person) | $99 to $199 per month; 8 cents to 15 cents per transaction |

Third-party integrations | 500-plus, including QuickBooks, Amazon Web Service (AWS) and NetSuite | Open application programming interface (API), plus built-in integrations such as QuickBooks, Salesforce and WooCommerce |

Hardware | Stripe Reader S700, Stripe Reader M2, BBPOS WisePOS E terminal and BBPOS WisePad 3 | Dejavoo Z8, Z9 and Z11; Clover products |

Payment methods | Online checkout, virtual terminal and Apple/Google Pay | Online checkout, virtual terminal and Apple/Google Pay |

Customer service | 24/7 support by phone, chat and email | Chat, email and account manager (Ultimate plan only) |

Who is Stripe for?

Stripe is best for e-commerce businesses, especially those that can access in-house web developers. Learn more in our full Stripe review.

Who is Stax for?

Stax works well for high-volume businesses because it features flat-rate pricing. Check out our full review of Stax for more information.

Stripe vs. Stax service comparisons

In this section, we dive deeper into what these two services offer and how they differ from each other.

Plans and pricing

Stripe plans and pricing

Stripe features an interchange-plus pricing model. Under this model, the credit card processor charges a percentage of the transaction on top of the credit card company’s interchange rate, plus a small flat fee. These rates generally depend on the payment method.

Type of charge | Cost |

|---|---|

Online domestic card charge | 2.9% plus 30 cents for each transaction |

In-person payments through a virtual terminal | 2.7% 5 cents for each transaction |

Automated Clearing House payments | 0.8% with a $5 cap |

Digital wallet payments such as Google Pay, Apple Pay, Click to Pay, WeChat Pay and Alipay | 2.9% plus 30 cents for each transaction |

Stripe also offers Afterpay, which allows customers to break up larger purchases into four equal installments, while the merchant gets paid the entire amount upfront. The rate for Afterpay is 6% plus 30 cents for each transaction.

Stripe charges an additional 1% fee for international cards; currency conversion costs another 1%.

Stripe also offers an invoicing tool for recurring payments. Stripe assesses a 0.4% fee (or a maximum of $2) per invoice amount.

Stax plans and pricing

Stax offers flat-rate pricing, which is completely different from Stripe’s pricing model. Instead of taking a percentage of the transaction, Stax charges a monthly subscription fee, plus a small per-transaction fee.

Stax currently offers three subscription tiers:

Service plan | Monthly cost | Features |

|---|---|---|

Growth | $99 |

|

Pro | $159 | All features in the Growth plan, plus:

|

Ultimate | $199 | All features in the Pro plan, plus:

|

In addition to the monthly subscription fee, Stax charges a per-transaction fee of 8 cents for EMV credit card terminals and 15 cents for all other payment methods, including mobile card readers and online transactions.

Additional fees:

- Chargeback: Should a customer initiate a chargeback by disputing a charge and seeking a refund, a $25 chargeback fee will be incurred.

- Noncompliance: Failing to meet the necessary security requirements will result in a substantial $54.99 PCI noncompliance fee.

- Below-quota processing: If you do not process at least a specified amount per month, you will also be subject to a $25 fee.

You can avoid chargebacks by following best practices, such as posting a clear refund and shipping policy.

Winner

Choosing between Stripe and Stax on pricing is an apples-to-oranges comparison because the two companies offer completely different pricing models. A lot depends on the size of your business and how it operates. Stripe is best for a business with low transaction volume and it also works well if you have a large online presence. Stax is a better choice for high-volume businesses because it doesn’t take a cut of your revenue, which may improve your profit margins. Ultimately, we would call this one a tie.

Payment methods

Stripe processing

Stripe is well known for its emphasis on cutting-edge technology. The company provides a variety of different ways for business owners to accept payments:

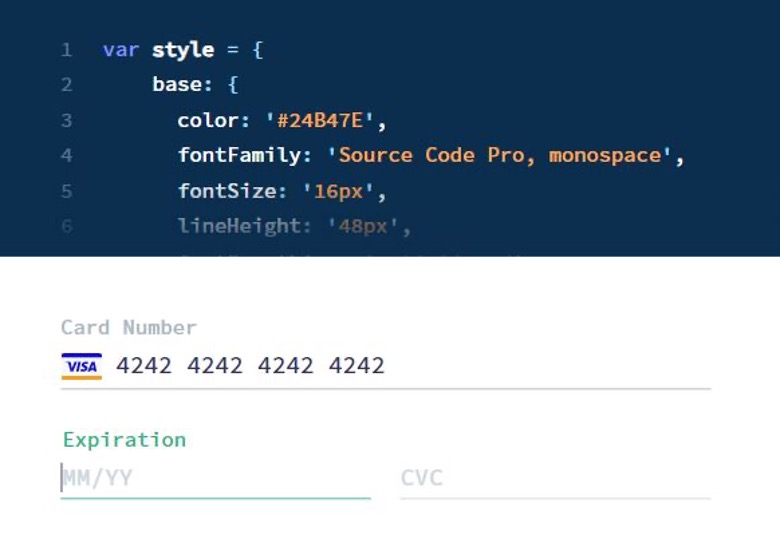

- Checkout: One of the easiest ways to accept payments is to embed a premade Stripe checkout form onto your website. If you have coding skills, you can further customize the form to match the branding of your business.

- Stripe billing: With this API, you can build a custom solution for recurring payments and subscription-based businesses.

- POS hardware: Stripe offers its own proprietary hardware and the software is compatible with several third-party point-of-sale (POS) devices.

With Stripe, you can hire a developer or use your coding skills to build custom solutions. Source: Stripe

Types of POS hardware include options, such as tablets, cash drawers, receipt printers, card readers and credit card terminals.

- Virtual terminal: The Stripe virtual terminal allows you to manually key in transactions so you can accept payments over the phone.

- Mobile payments: The Stripe mobile app allows you to accept payments on the go, turning your smartphone into a POS system.

- Mobile wallet: Stripe supports a wide variety of digital wallets, including Apple Pay, Google Pay, Samsung Pay, Visa Checkout, Masterpass by Mastercard, Amex Express Checkout, Microsoft Pay, Alipay and WeChat Pay.

Stax processing

Stax offers a slate of payment methods that are standard among credit card processors:

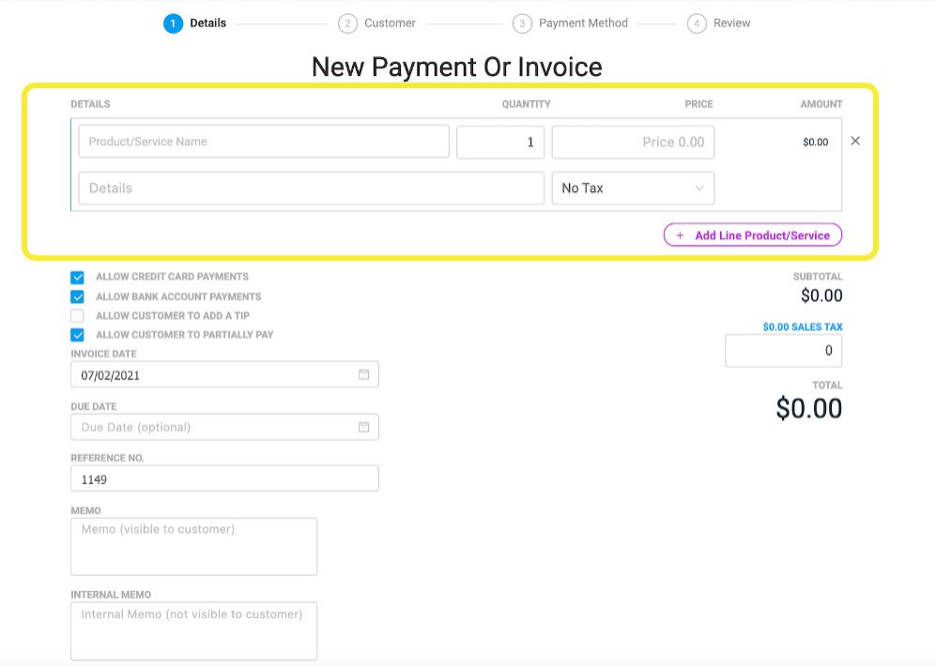

- Virtual terminal: You can access the Stax virtual terminal on a web browser. This application can be used to key-in information to accept credit card payments over the phone. Stax’s virtual terminal can also be used to set up recurring billing.

- Shopping cart: Use Stax to set up an online storefrontand build custom shopping carts to integrate into your site.

- Mobile app: The Stax Pay mobile app can be paired with mobile reader hardware to accept credit cards over the phone. Like the virtual terminal, you can also manually enter customer information via the app.

- POS hardware: Stax is compatible with several third-party POS equipment providers, including Clover.

Stax allows you to send invoices through email or short message service for easy payment. Source: Stax

Winner

Again, it’s difficult to compare Stripe and Stax in this respect because a lot depends on the type of business that you run. Based on the number of different payment methods and extensive customization ability, we would name Stripe the winner. However, it might not be the best choice for less tech-savvy business owners. Stax features a mobile app and processing methods that appeal more to brick-and-mortar businesses or business owners who want a less technical solution.

Hardware

Stripe hardware

Stripe offers its own proprietary terminals and card readers and the software is also available for a few third-party POS devices. Options for hardware include:

- Stripe Reader S700: The handheld terminal supports EMV chip cards, contactless payments and magstripe cards.

- Stripe Reader M2: This mobile reader is designed to be paired with a smartphone. Like the terminal, it accepts EMV chip cards, contactless payments and magstripe cards.

- BBPOS WisePOS E: This third-party countertop reader connects to Stripe’s terminal software

- BBPOS WisePad 3: Third third-party handheld reader is designed to be paired with a smartphone.

The Stripe Reader was introduced in 2023 as an in-house hardware option Source: Stripe

Stax hardware

Every Stax membership includes a complimentary terminal or mobile reader. Stax’s attractiveness lies in its ability to operate its credit card processing software on diverse systems. While Stax does not produce its own hardware, it does distribute equipment from external vendors. The company claims to offer this equipment at prices close to its own cost. These hardware options include the following:

- Dejavoo QD: This handheld terminal accepts EMV chip cards, contactless payments and magstripe cards.

- Swipe Simple B250 Reader: This device can be paired with a smartphone to accept EMV and magnetic stripe cards.

- Clover: Stax software is compatible with the full suite of Clover credit card processing hardware, including the Flex, Mini and Station.

Read our full review of Clover for more information on these products.

Winner

We would pick Stax as the winner on hardware because it offers greater variety than Stripe in terms of equipment options. Importantly, Stax is available on Clover’s hardware, which offers one of the best POS systems for small business owners. Combined with the third-party systems that Stax sells at a discount, just about any business can find something that suits its unique needs and budget.

Although we like that Stripe offers proprietary hardware, its hardware options are limited to mobile readers and handheld terminals. This might present some obstacles for small business owners that require more specialized hardware solutions.

Third-party integrations

Stripe software

Stripe features more than 500 built-in integrations with third-party business apps, including the following services:

- AWS

- Intuit QuickBooks

- Xero

- ServiceNow

- HubSpot

- Mailchimp

- Shopify

- Wix

- Zapier

Stax integrations

Stax offers more than a dozen third-party integrations, far fewer than the hundreds offered by Stripe. On the plus side, Stax does include an open API so that developers can integrate the credit card processing software easily into a third-party app. Built-in integrations include:

- Slack

- HubSpot

- Intuit QuickBooks

- Xero

- Microsoft Teams

- Zoho

- Google Docs

- Mailchimp

- monday.com

Winner

Stripe wins decisively on third-party integrations. The service offers more than 500 built-in integrations, including most of the integrations also offered by Stax. However, a few Stax integrations aren’t offered by Stripe. Business owners should consider which integrations they require and search for compatibility on Stripe and Stax.

Customer service

Stripe support

Stripe provides 24/7 support by phone, chat and email, as well as technical support on the techie/gamer app Discord. Other technical support resources include searchable documentation, online tutorials, articles and frequently asked questions (FAQs) on the Stripe website.

Stax support

Stax offers customer service via live chat, email and help ticket forms on the company website. Customers on the Ultimate plan can also contact a dedicated account manager. Other technical support resources include a searchable knowledge base and articles on the company website.

Winner

In our view, Stripe wins on customer service. We like that Stripe still offers phone support, which is uncommon for many small business software providers and also promises fast response times. The fact that Stax offers a dedicated account manager is a major plus but this feature is only available on its highest-tier plan. Regular customers do not have direct access to phone support.

Stripe vs. Stax Summary

- Stripe is best for business owners with a high degree of technical knowledge; others might find the software difficult to implement without help from a developer.

- Stax works better for less tech-savvy business owners or those with a high transaction volume.

- Stax’s hardware options make it a better fit for many brick-and-mortar businesses while Stripe’s focus on e-commerce makes it the best choice for online merchants.

- Stripe features more built-in third-party integrations as well as more options for customer service.

FAQs

Yes. Stax was previously called Fattmerchant; the company changed its name in 2021.

In most cases, Stripe payments take approximately two business days to settle.

Yes, you can cancel Stax anytime for no fee, but you must return any free equipment that you obtained from the company.